(Schiff)—The day of reckoning for unproductive credit is in sight.

With G7 national finances spiraling out of control, debt traps are being sprung on all of them, with the sole exception of Germany.

Malinvestments of the last fifty years are being exposed by the rise in interest rates, increases which are driven by a combination of declining faith in the value of major currencies and contracting bank credit. The rise in interest rates is becoming unstoppable.

Do not be surprised to see a US Government deficit exceeding $3 trillion this fiscal year, half of which will be interest payments. And in the run-up to a presidential election, there’s every sign of deficit spending increasing even further.

We now face America and her allies being dragged into another expensive conflict in the Middle East, likely to drive oil and natural gas prices higher; far higher if Iran becomes a target. With the Muslim world united against Western imperialism more than ever before, do not discount the closure of Hormuz, and even Suez, with unimaginable consequences for energy prices.

The era of interest rate suppression is over. G7 central banks are all deeply in negative equity, in other words technically bankrupt, a situation which can only be addressed by issuing yet more unproductive credit. These are the institutions tasked with ensuring the integrity of the entire system of bank credit.

This is not a good background for a dollar-based global credit system that is staring into the black hole of its own extinction.

The end for the dollar is nigh

There are a number of events coming together that suggest we are about to undergo a major upheaval in world economic, financial, and monetary affairs. It’s like one of those bush fires, which you fight in front of you, only to find that suddenly the flames are behind you as well, then on your right and your left. It becomes so hot that things are spontaneously combusting all around you and there is no escape. This is the condition currently faced by central bankers.

Just when interest rates have risen to a peak, they seem to be rising again. Surely, investors argue, the firefighting central banks must lower rates to save debtors, to save the banks, and to save themselves. But they do not control interest rates. They are being set by debt traps and over-leveraged banks trying to control lending risk. Accelerating demand for credit to pay higher interest rates is meeting a growing reluctance to lend. And to top it all, an alliance of Russia, the Saudis, and Iran are deploying control of the global oil supply, with the intention of forcing prices higher. Energy is the lifeblood of any economy. The last thing the West needs is another war in the Middle East. And now we look like having that as well.

The history of the dollar as the world’s reserve currency has been one of struggling from crisis to crisis on a worsening trend. Recent history saw the credit bubble of the nineties ending with the dot-com madness and its collapse, followed by what was commonly termed the Great Financial Crisis of 2008—2009. Given our current predicament, that description seems like mere hyperbole, because we now face an even greater crisis. Is it possible to kick the tin can down the road once again?

It seems unlikely, even allowing for the past experience of successful statist rescues from financial crises: somehow, the authorities have always been able to calm a crisis. But this time, the Global South, the nations standing to one side of all this but finding their currencies badly damaged by unfavorable comparisons with a failing dollar, a dollar forced into higher interest rates in a world that knows of nowhere else to go — this non-financial world is on the edge of abandoning American hegemony for a new model emerging from Asia.

The transition from the global status quo is bound to be a difficult affair. That the US Government is ensnared in a debt trap and is being forced to borrow exponentially increasing amounts just to pay the interest on its mountainous debt is not the fault of other nations. But many of them in turn are being forced to pay even higher interest rates, irrespective of their budgetary positions, and irrespective of their balance of trade. Yet their currencies continue to weaken even against a declining dollar.

The lesson for all of them is to not listen to the mathematical economists spouting Keynesian and monetary theories. The Russians with a trade surplus and a debt-to-GDP ratio of under 20% even when it is at war compare extremely well statistically with the US Government. If it wasn’t Russia, we would rate its financial condition highly. But the rouble still collapses, forcing Russia’s central bank to raise its short-term interest rate to 15%. The reason is simply that no one trusts roubles, but they still believe in the dollar as a safe haven.

However, there is every sign that the 52-year era of the purely fiat dollar is ending. Some foreign governments appear to be liquidating their US Treasury holdings to protect their own currencies. Japan, which is fighting to keep its yen from further collapse, has been selling recently, as has China (though for her there may be political reasons as well). The knock-on effects of the dollar’s debt trap are vividly apparent in weakness for the yen, yuan, rupee, and euro whose charts against the dollar are shown below. The effect of the dollar’s strength on lesser currencies is even worse.

Everyone assumes that the Fed must and will end this madness, not least because of the consequences for overindebted American businesses, the banks, and the Treasury itself. But what if the Fed is powerless, what if the situation is escalating beyond its control, and what if by reducing its funds rate the dollar would simply weaken pushing up consumer prices? And what if the Treasury finds funding the Government’s massive borrowing difficult even at higher interest rates?

Suddenly, that appears to be increasingly likely. The global south, which is the new name for those either in the Asian hegemons’ camp or considering joining it will need to find an alternative to being compared unfavourably in the foreign exchange markets with a failing dollar. The pressure for a whole new monetary system for the emerging nations is increasing.

In the past, currency boards linking a failing currency firmly to the dollar have been an effective solution. The problem for all currencies not formally tied to the dollar is that they will always be secondary forms of fiat. There is only one answer, and that is to abandon the dollar and return to tried and trusted gold standards.

Gold is real legal money internationally, whose value is constant over time. The world is learning the hard way that it is unattached credit which is unstable. And as the US sinks deeper into its debt trap a fiat currency credit crisis is just beginning.

Don’t wait for a stock market crash, dedollarization, or CBDCs before securing your retirement with physical precious metals. Genesis Gold Group can help.

In this article, we look at the major moving parts that are leading to the end of the entire fiat currency system. It is not just the dollar in crisis. By following the same monetary and economic policies, the Eurozone, Japan, and the UK are in similar difficulties, not to mention a host of other advanced nations.

The US Government’s debt trap

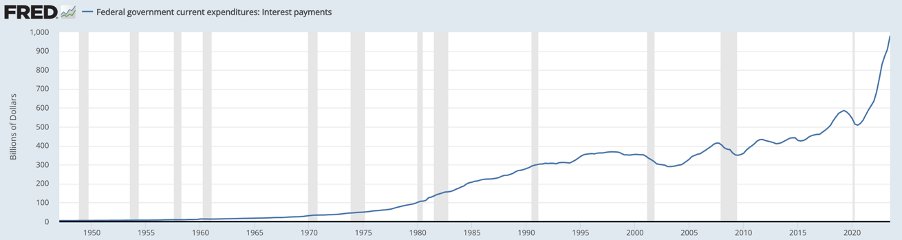

Last May, the Congressional Budget Office forecast a budget deficit of $1.5 trillion for fiscal 2023, which ended last September, including net interest payments on government debt of $663bn. The St Louis Fed’s chart below shows that the interest element was wildly underestimated. The outturn was actually $981bn, 48% higher than the CBO expected.

In its debt interest forecast, the CBO estimated the net interest rate to be 2.7%. At the time the forecast was published, the 3-month T-bill rate was over 5%, but the yield curve was deeply negative, with the 10-year US Treasury note yielding 3.7%. In the current fiscal year, the CBO estimated the interest cost to average 2.9%. But with the current year’s deficit likely to be considerably higher, and $7.6 trillion of maturing US Treasury debt required to be refinanced at current and potentially higher rates, official estimates of interest costs are far too low. In fact, the CBO didn’t expect interest costs to exceed 3% until fiscal 2030.

More realistic estimates will emphasize the debt trap danger. The deficit outturn was officially stated as $1.69 trillion, to which a further $300bn must be added back because when President Biden’s proposal to pay off student loans was rejected by the Supreme Court, the money “saved” was simply added back as a reduction in expenditure. A truer figure for the 2023 deficit was $2 trillion.

Nevertheless, at $981bn debt interest was approaching half the total deficit. The deficit for the current fiscal year commences with interest on $33.5 trillion of which $26.3 trillion is in public hands, and the average interest rate is not going to be the CBO’s estimate of 2.9%. Already, we see the cost of funding the $7.6 trillion of debt being refunded this year plus the $1 trillion of existing interest costs having risen to over 5%, adding an extra $200bn on interest costs alone.

To this must be added additional interest costs for the underlying budget deficit this year. There is no knowing how high this will be. But allowance for the consequences of higher interest rates must be made, which are essentially recessionary. Much has been made of recent figures showing US GDP growing persistently, with the third quarter outturn up 4.9%, leading to the Fed’s tight monetary policy being justified. But there are fundamental errors in this way of thinking which radically affects the budget outcome.

If we look at raw GDP figures, we see that in the 2023 fiscal year, GDP increased by just under $1.9 trillion. Including the student loan accounting trick, this is remarkably close to the $2 trillion budget deficit. While we cannot equate the two numbers absolutely, particularly when nearly half the deficit is interest expense, we should not ignore the fact that some of this interest enters the real economy, there are additional deficits from state governments, and that the rest of the deficit contributes almost entirely to GDP.

Therefore, instead of nominal GDP increasing 7.5%, private sector GDP probably increased hardly at all. But the rate of CPI inflation for the fiscal year was recorded at 3.6%, or according to Shadowstats.com based on the original 1980-based calculation method about 12% — take your pick. We can therefore say that despite the bullish growth headlines and allowing for CPI inflation, the US is already in recession.

This is the background to the US Government’s revenue income and expenditure prospects for fiscal 2024, confirmed by business surveys and anecdotal evidence. Already, we can see that estimates of tax revenue will fall short because profits decline in a recession and unemployment rises (with respect to unemployment, government statistics are notoriously unreliable and can be safely disregarded). While tax revenue declines, mandated welfare and other costs increase. Taking the last fiscal year’s ex-interest deficit of about $1.1 trillion as our base, the current year’s deficit will be significantly more due to the recessionary consequences of higher interest rates. And President Biden is trying to get a revised version of student loan relief past the courts, emblematic of yet more increases in government spending. After all, the current fiscal year is the last in the Presidential election cycle when traditionally electors are bribed with extra government spending.

Let’s pencil in a reduction of revenue by $500bn and an increase in outgoings of a similar amount to increase the deficit ex-interest by about $1 trillion to $2 trillion.

The interest bill is already growing exponentially. We can see that the funding requirement for new debt will be $2 trillion in excess spending, plus at least another $1.3 trillion of interest (allowing for the $7.6 trillion of debt to be refinanced), totaling over $3.3 trillion in total. Clearly, it won’t take much more of a credit squeeze and the increasing likelihood of a buyers’ strike to push the interest bill to over $1.5 trillion.

Higher interest rates are accelerating the debt trap

I have recently written about why in a world of fiat currencies interest rates do not represent “the cost of credit” except perhaps to borrowers. It is more about what a depositor thinks the purchasing power of the currency will be at the end of a loan period, plus something for counterparty risk, and plus another something for the temporary loss of the use of the depositor’s funds, the last of which is known as time preference. Unless the Fed understands this (and there’s not much evidence that this is so) then interest rate policy is fatally misguided.

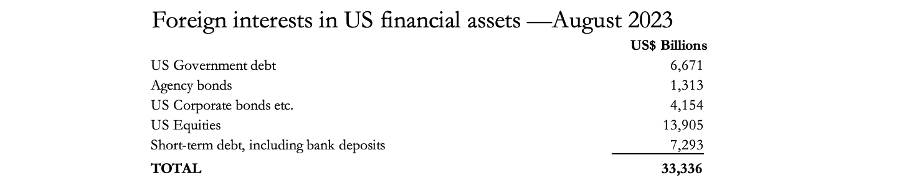

There are two categories of lenders to consider — domestic who are generally captive, and foreign who are not. The reasons foreigners hold dollars and dollar assets are to do with trade settlement requirements, including the purchase of commodities which are nearly always priced and valued in dollars, and investment. On both these grounds, their requirements are changing, probably for the worse. Higher interest rates are hitting global production, leading to less demand for trade dollars, and at some stage higher interest rates will lead to portfolio losses and widespread portfolio liquidation of dollar assets by foreign investors.

Foreign interests in dollars are split as shown in the following table.

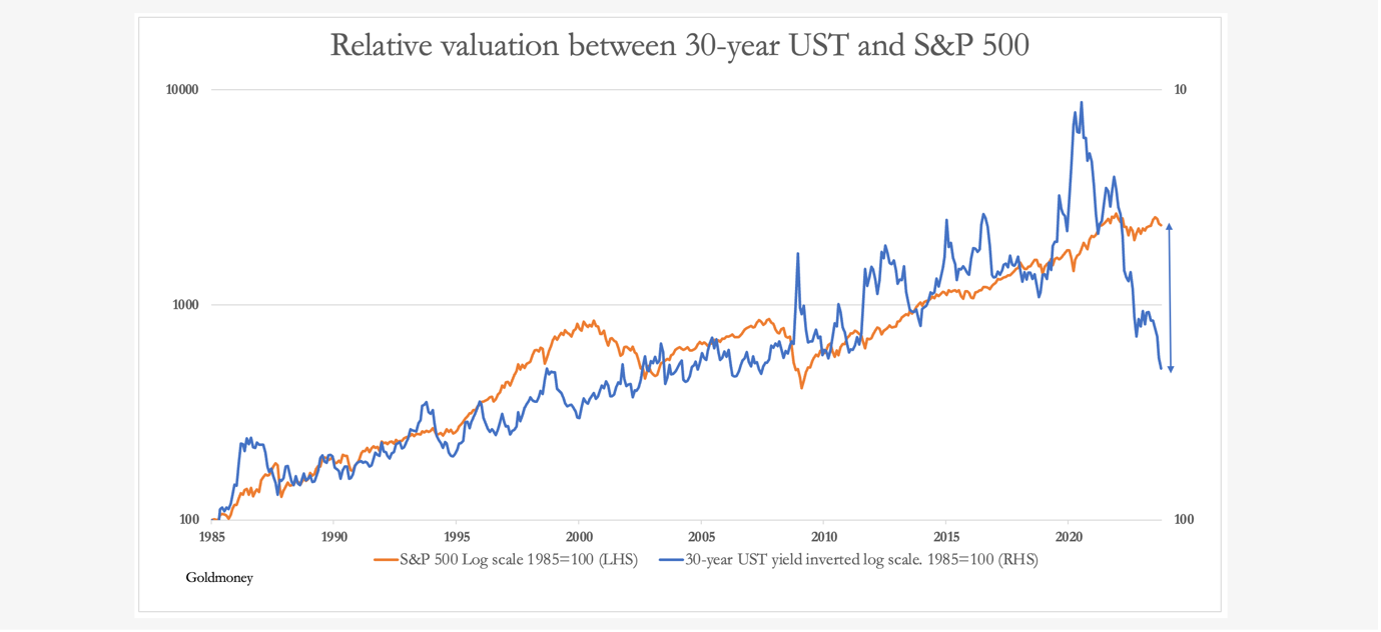

Other than the short-term debt of $7.293 trillion, the rest of these financial assets are highly interest rate sensitive, equities acutely so which is the largest investment category. The next chart shows the valuation gap that has already opened up between rising bond yields and equities represented by the S&P 500 Index (arrowed).

The chart shows the tight negative correlation between the yield on the long bond (right-hand scale) and the S&P 500 Index (left-hand scale) by inverting the yield. Since the Lehman crisis, the falling bond yield has led the S&P higher, to an extreme divergence in July 2020. Since then, the divergence has reversed spectacularly, indicating that the S&P is now wildly overvalued relative to bond yields and a sharp fall in equities is almost certain. On this basis, a target for the S&P (currently 4,120) of between 500 and 1000 can be justified if this valuation gap is to close and if the long bond yield remains at current levels or higher.

Survival Beef on sale now. Freeze dried Ribeye, NY Strip, and Premium beef cubes. Promo code “jdr” at checkout for 25% off! Prepper All-Naturals

If, as seems very likely, US bond yields rise from here, US equities are due for a significant crash. In that event, with financial asset values falling there can be little doubt that foreign investors will be reducing their exposure dramatically. Some of this reduction is likely to lead to higher short-term balances in banks and T-bills. But it is hard to envisage foreign liquidation of US assets not leading to dollar selling. Some of this liquidity is bound to return to its currencies of origin because, from an accounting point of view, that is always the risk-free option. But some of it is bound to go into physical gold because that is the risk-free international money.

Why interest rates will rise from here and the consequences

The valuation gap between bonds and equities is not unique to the US, being in common with other financial jurisdictions as well. That it exists indicates investors are discounting lower interest rates in time. But what if this is wrong, and interest rates are headed higher still?

In the introduction, I mentioned the alliance between Russia, Saudi Arabia, and Iran, who with the Gulf Cooperation Council dominate global oil and gas supplies. These nations have an interest in ensuring that oil’s value, priced in declining dollars, is maintained in real terms. Furthermore, Russia sees energy prices as an economic weapon useful for putting pressure on European NATO members with a view to splitting them off from American control. And now we face a new flashpoint between Israel and Hamas, which is likely to spread to a conflict involving America and Iran, which could lead to the closure of the Straits of Hormuz, and possibly Suez as well.

For now, markets appear to be complacent in the face of these factors. But as the situation evolves this is unlikely to last, and oil and gas prices could rise significantly as these risks grow.

European energy stocks are insufficient to see Europe through the winter, and the US’s strategic reserves are depleted. There is no better time for this OPEC+ cartel to force prices higher, and by recently cutting the supply of 1.3 million barrels of oil per day that is precisely what the Saudis and Russia are doing. Heating oil and diesel prices are likely to rise strongly as well, if only because Russia has stopped exporting these distillates. The relevance of diesel is that over 95% of all European distribution logistics are delivered by diesel power, increasing the production and delivery costs of all consumer goods.

Consumer prices are what the central banks watch when setting interest rates. And due to energy factors, the outlook is for rising consumer and wholesale prices to accelerate again. Additionally, commercial banks’ balance sheets are highly leveraged, and they have been caught with bond investment values declining while funding costs have risen above their yields. They find that commercial property loans and lending to businesses are threatened by higher interest rates and recessionary conditions. In the current interest rate environment, there are very few buyers for these assets if banks are forced into liquidating collateral against loans. Consequently, they are reducing bank lending and de-risking their balance sheets where they can.

This is why irrespective of central bank policy, the shortage of credit is driving borrowing rates higher, and the cost of novating maturing debt is rising, if the credit is actually available — which increasingly is rarely the case. It is an old-fashioned credit crunch, not really seen since the 1970s. And it has only just started.

These conditions are very different from the long decline in interest rates from the 1980s, and the subsequent period when they sat at or below the zero bound. The world of fiat currencies has become destabilized, not by the detachment from gold and the market’s adjustment to it as was the case in the 1970s, but by extreme interest rate suppression, inflationary excesses, unproductive debt creation, and massive government debt overhangs. Debt-to-GDP ratios of the G7 group of countries in 2022 averaged 128%. This list was headed by Japan at 260.1%, followed by Italy at 144%, the US at 121.3%, France at 111.8%, Canada at 107.4%, the UK at 101.9%, and Germany at 61.8%. The conditions of currency instability of the 1970s with their higher interest rates have returned, giving rise to an overriding question: how are these budget deficits going to continue to be financed?

US deficits were financed since the early 1980s against a long-term trend of declining bond yields, so every participant in bond auctions began to know that in time bond values would always improve, even if the short-term outlook was uncertain. That is no longer the case.

While it would be a mistake to ignore the skills with which the authorities and the primary dealers manage debt auctions, with a trend of rising rates there will be times when auctions are bound to fail. In the 1970s, this happened several times in the UK, primarily because the UK Treasury effectively managed the debt management office through its control of the Bank of England and Treasury officials didn’t understand markets. Nevertheless, we saw gilt issues with coupons of 15% and over. Imagine what similar funding rates would do to government finances today, with the G7 debt ratio averaging 128% last year.

Relatively quickly, some governments are bound to run into severe funding difficulties, which can only be resolved by overtly inflationary means.

The entire G7 banking system is broken

A further problem arising from the excesses of the past is that the entire banking system from central banks downwards is in dire straits. Central banks that implemented QE did so in conjunction with interest rate suppression. The subsequent rise in interest rates has led to substantial mark-to-market losses, wiping out their equity many times over when realistically accounted for. Central banks claim that this is not relevant because they intend to hold their investments to maturity. However, in any rescue of commercial banks, their technical bankruptcy could become an impediment, undermining faith in their currencies.

- Concerned about your life’s savings as the multiple challenges decimate retirement accounts? You’re not alone. Find out how Genesis Precious Metals can help you secure your wealth with a proper self-directed IRA backed by physical precious metals.

As the reserve currency for the entire global fiat currency system, the dollar and all bank credit based upon it is likely to be the epicenter of a global banking crisis. If other currencies weaken or fail, there could be a temporary capital flight towards the dollar before a wider financial contagion takes over. But if the dollar fails first, all the rest fail as well.

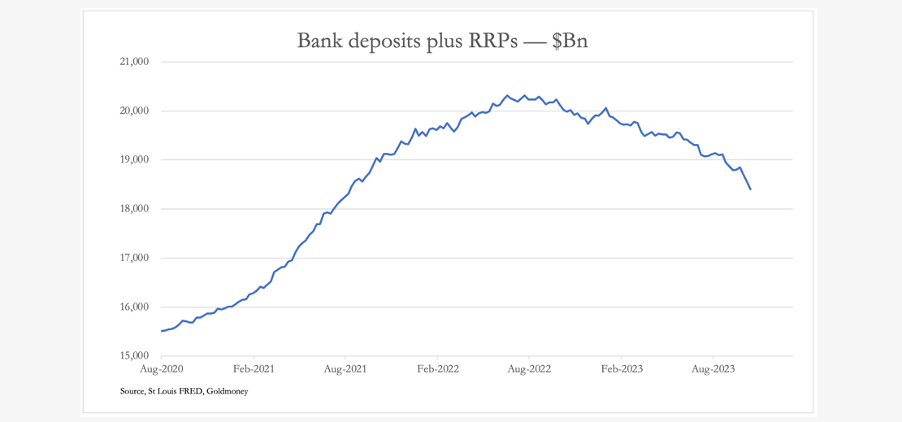

The condition of the US banking system is therefore fundamental to the global economy. But there are now signs that not only is US bank credit no longer growing but it is contracting sharply.

The chart above is the sum of all commercial bank deposits plus reverse repurchase agreements at the Fed. While the latter are technically not in public circulation, they have been an alternative form of deposits for large money market funds that otherwise would be reflected in bank deposits. Recently, having soared from nothing to a high of $2,334.3 billion last September, reverse repos subsequently declined by $1,250 billion. Subtracting this change from bank deposits shows the truer contraction of bank credit to be $1,918 billion, which is a 9.4% decline from the high point earlier this year.

This contraction of credit in the banking system is likely due to reverse repo funds switching into Treasury bills, short-term government debt deemed to be the safest form of investment. It is wholly consistent with bank and shadow bank credit being de-risked.

The situation facing the other major fiat currencies differs mainly in the details. It is a sad fact that Basel III regulations have addressed balance sheet liquidity problems but failed to contain excessive expansion of bank credit relative to shareholders’ capital. Consequently, regulators in the Eurozone and Japan have tolerated asset-to-equity ratios of over twenty times for their global systemically important banks, when in the past ratios of twelve to fifteen times were deemed to be dangerously high. The contraction of bank credit is therefore likely to be more catastrophic in these jurisdictions than in the US, where ratios for major commercial banks are commonly less than twelve times.

Estimating balance sheet ratios does not tell the whole story. There are off-balance sheet factors as well, principally liabilities in regulated and over-the-counter derivative markets, which for the G-SIBs are larger than their entire balance sheets combined. According to the Bank for International Settlements, open interest in regulated futures totaled $37 trillion in June 2023, and in December last year, the notional value of OTC derivatives stood at an additional $630 trillion, giving us a total of $667 trillion. Banks, insurance companies, and pension funds are the counterparties in these transactions, and the failure of a significant counterparty acting in these markets could threaten the entire Western financial system.

The big picture is of an asset bubble which has come to an end. And by any standards, this one was the largest in recorded history.

Geopolitics and gold’s renaissance

The fiat currency problem is likely to be made more immediate by a new factor of nearly four billion people rapidly industrializing under the leadership of China and Russia. The evidence strongly suggests that these two hegemons see monetary matters similarly to the author of this article and that they are now ready to protect themselves from an impending collapse of their western enemies’ currencies.

China and Russia have accumulated significant quantities of gold, and by gold mine output is the world’s largest by far. The prospect of the Asian hegemons returning to gold standards is bound to draw attention by contrast to the weaknesses and fallacies behind fiat currencies.

For those of us under the yoke of fiat credit detached from any corporeal values, there is only one escape from a banking system that is now imploding. And that is to possess legal money as much as possible, which by both longstanding law and human habit is gold in bar and coin form. Physical silver is the money for smaller purchases. That is why Goldmoney was founded over twenty years ago, with the objective of providing a safe haven from a monetary system that was eventually bound to collapse. That moment now appears to have arrived.

The likelihood of a dollar collapse is being enhanced by the string of failed US foreign policies. Iraq, Syria, and Afghanistan are on the list, with other ventures, such as the collapse of Libya creating refugee havoc for Europe. It appears that Ukraine is a lost cause as well. And now, the Western alliance is swinging behind Israel in her attempt to root out Hamas from Gaza.

Any objective analysis indicates that US involvement is very likely to bring Hezbollah into the conflict, which involves Syria and Iran. There are US assets in Syria, which would then become a target for Iran, and Iran can easily block the Straits of Hormuz, choking off 20% of the world oil supply, and 18% of LNG. In that event, energy prices would obviously spike far higher, sharply pushing up G7 interest rates. Rational analysis suggests that this possibility would ensure that America and her NATO partners should back off and attempt a diplomatic solution.

Subscribe for free to the America First Report newsletter.

The evidence is to the contrary, with America and Britain sending aircraft carriers into the Eastern Mediterranean, and Russian Mig fighters patrolling the Black Sea in striking distance of the Western alliance’s carriers.

What has changed is Muslim unity, fused together even more by Israel’s collateral damage against Palestinian citizens. Both Sunni and Shia Muslims, representing two billion people are now united against the Western alliance and its culture. The US’s policy of divide and rule is no longer appropriate.

US foreign policy is in tatters. If it presses ahead to reassert its dominance over the Middle East by getting involved militarily, the US will lack the support of former regional partners, and inevitably the threat to oil supplies will divide her NATO partners. If she decides not to get involved, that will confirm to the Middle East and the Global South that her days as the global hegemon are over.

Either way the prospects for King Dollar are not good. In a war scenario, there may be a temporary flight to the dollar before the implications for interest rates and financial asset values are better understood. If the US backs off, there may be a temporary relief rally in financial assets, but the message for the dollar is it is over-owned, and with the decline of US power, it should be sold on the foreign exchanges for gold.

What Would You Do If Pharmacies Couldn’t Provide You With Crucial Medications or Antibiotics?

The medication supply chain from China and India is more fragile than ever since Covid. The US is not equipped to handle our pharmaceutical needs. We’ve already seen shortages with antibiotics and other medications in recent months and pharmaceutical challenges are becoming more frequent today.

Our partners at Jase Medical offer a simple solution for Americans to be prepared in case things go south. Their “Jase Case” gives Americans emergency antibiotics they can store away while their “Jase Daily” offers a wide array of prescription drugs to treat the ailments most common to Americans.

They do this through a process that embraces medical freedom. Their secure online form allows board-certified physicians to prescribe the needed drugs. They are then delivered directly to the customer from their pharmacy network. The physicians are available to answer treatment related questions.

Very complex sounding, very academic appearing, sure sounds sophisticatedd —- now don’t it???

Except, America went pure FANTASY FINANCE the past few decades with the adoption of credit derivatives — the extension of the MONEY CREATION ENTITLEMENT of the Super–Rich! Never made any sense other than that – Timothy Geithner’s memo to Larry Summers during the Clinton Administration that the WTO Financial Services Agreement MUST contain a “credit derivatives clause” (uncovered by investigative reporter, Greg Palast) set the global financial stage!

First recommended for adoption by the American Bankers Association, the original Credit Default Swap created by Blythe Masters at JPMorganChase (she would later move on to BLOCKCHAIN TECHNOLOGY) —— the Group of Thirty, lobbyist group for the central bankers and founded by the Rockefeller Foundation in 1978, strongly recommended “the removal of legal risk” for credit derivatives, which the WTO inclusion and the many banker pieces of legislation signed by President Billygoat Clinton insured!!!

Fantasy finance —- when the Soviet Union dissolved from endless weapons expenditure in 1990/1991, the US simply opted for credit derivatives . . . doable since the USD was the world’s reserve currency!

[FYI: A subset of that money creation entitlement is CAP–AND–TRADE/CARBON PERMITS, allowing banks and energy corporations to create sums of $$$; how Al iGore accumulated his $300 million fortune!]