- Watch The JD Rucker Show every day to be truly informed.

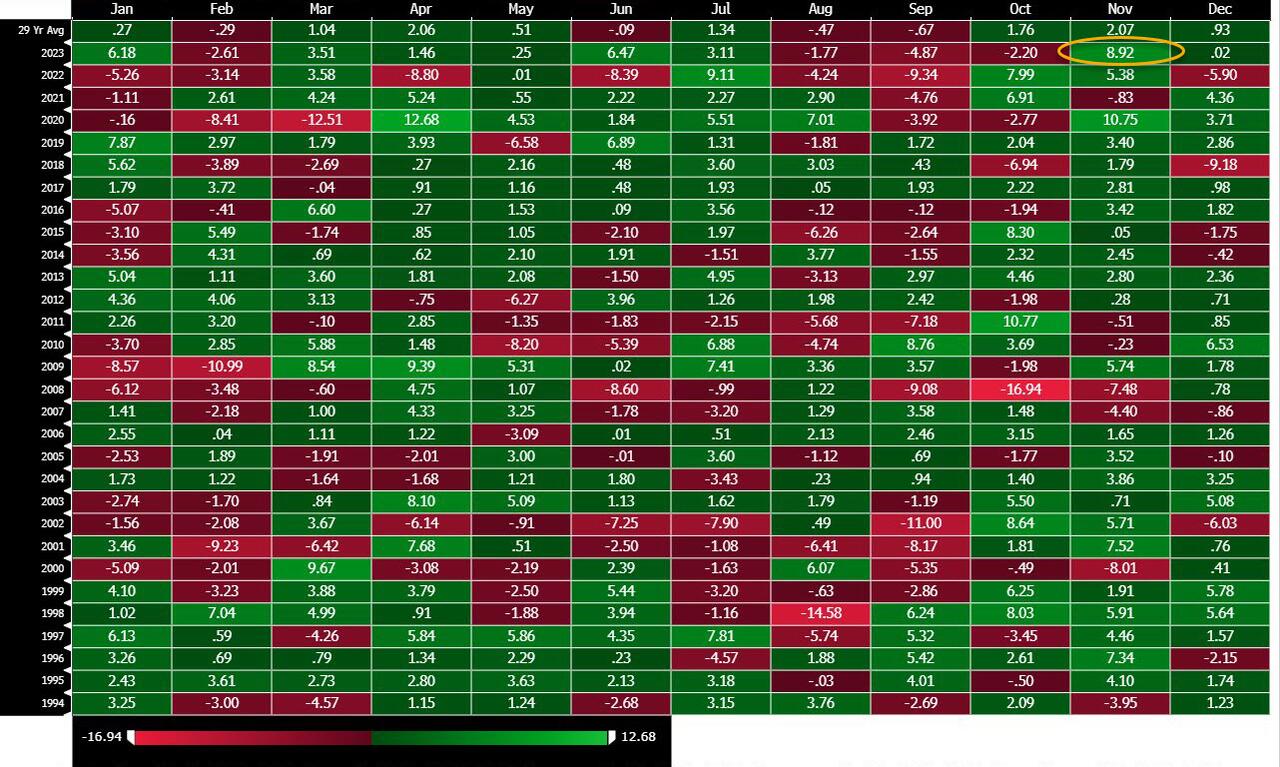

(Zero Hedge)—After November’s furious meltup, which saw the S&P rise by 9% (the Nasdaq was up an even more ludicrous 11%), which was the best November for the stock market since 1980…

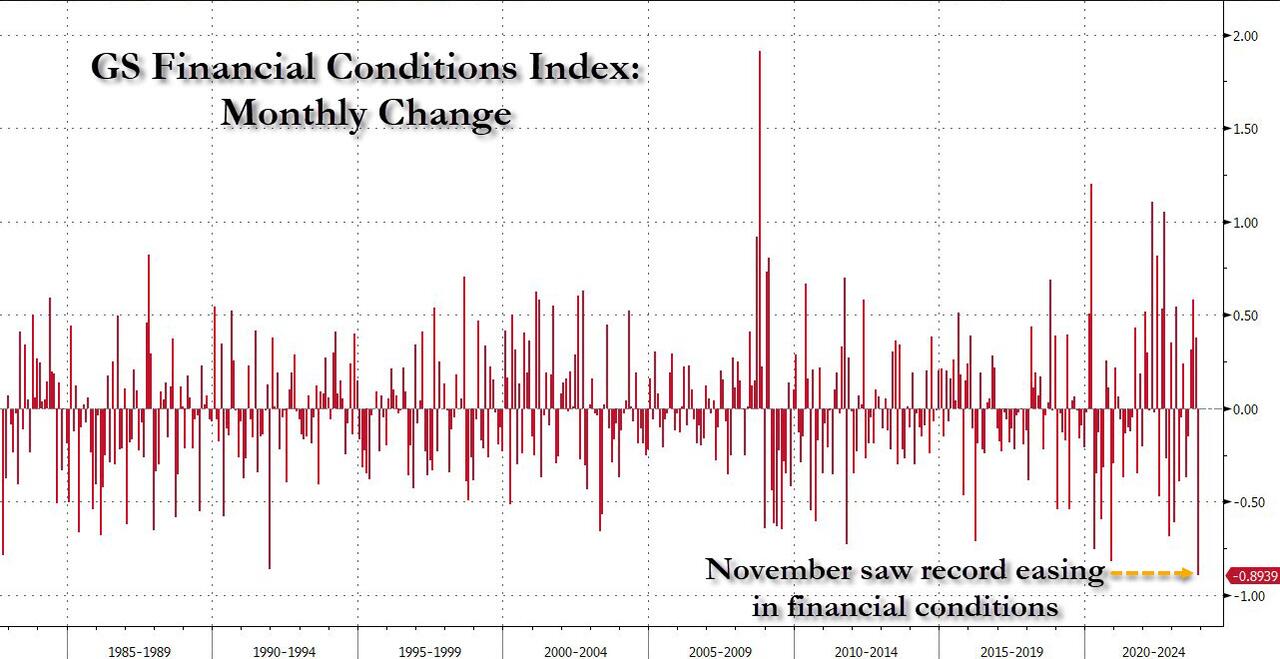

… all eyes were on Jerome Powell today to see if the Fed chair would say something to stem the surging stock market tide following the month which saw the biggest easing in financial conditions on record, equivalent to nearly 4 rate cuts.

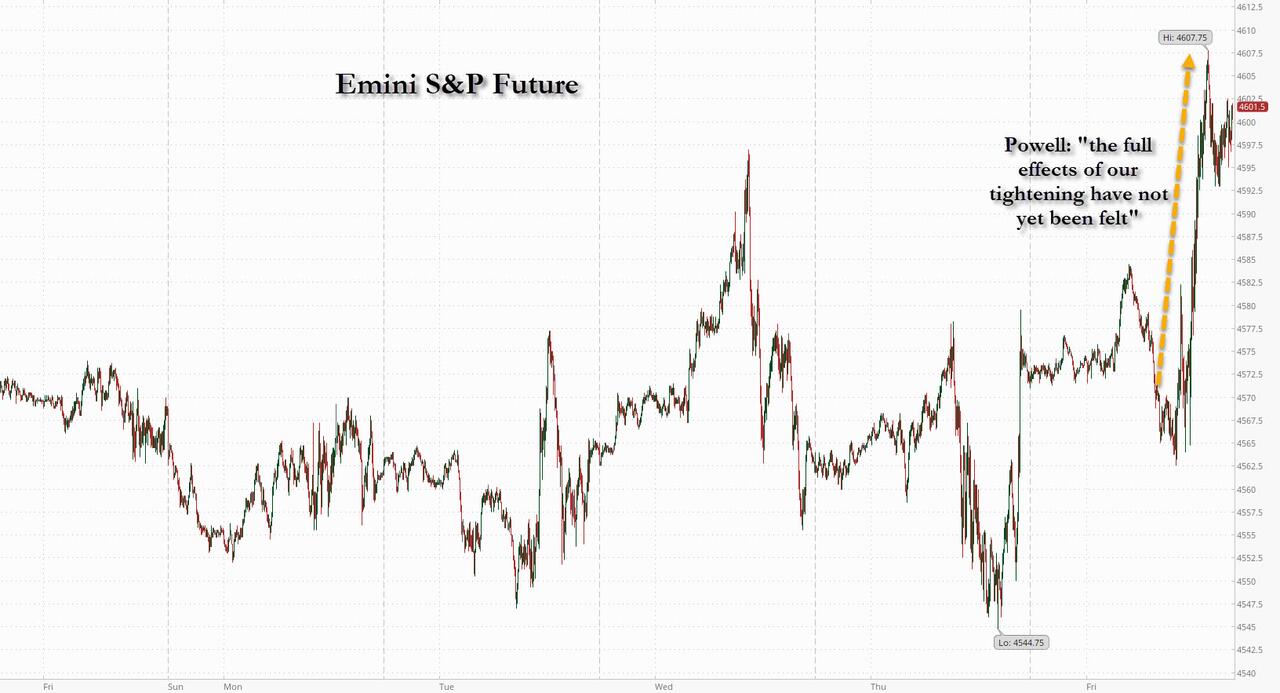

We got the answer shortly after 11am ET, when after what seemed to be otherwise balanced remarks with a dose of hawkish comments…

“It would be premature to conclude with confidence that we have achieved a sufficiently restrictive stance, or to speculate on when policy might ease. We are prepared to tighten policy further if it becomes appropriate to do so.”

… offset by some clearly dovish statements…

“The strong actions we have taken have moved our policy rate well into restrictive territory, meaning that tight monetary policy is putting downward pressure on economic activity and inflation. Monetary policy is thought to affect economic conditions with a lag, and the full effects of our tightening have likely not yet been felt.”

… and generally sounding rather optimistic while answering student questions, saying that the US is on the path to 2% inflation without large job losses – i.e., a soft landing – which helped the market to convince itself that Powell had just given the green light for a continued market meltup (thanks to the blackout period, there will be no more Fed comments until the Dec 13 FOMC) as Bloomberg put it…

“Powell points to how the Fed’s past tightening moves will continue to have an impact on the economy — the full impact hasn’t been felt yet. If anybody thought the Fed wasn’t finished raising rates, his prepared remarks today sure put a fork in it. They are done.”

…. and what happened next was a violent repricing in easing odds, with March rate cut odds hitting a lifetime high of 80%, effectively doubling overnight and up from 10% just 5 days ago…

… which then immediately cascaded across assets and sent everything exploding higher, led by stocks which surged above 4,600 for the first time since the July FOMC (aka the “final rate hike”)…

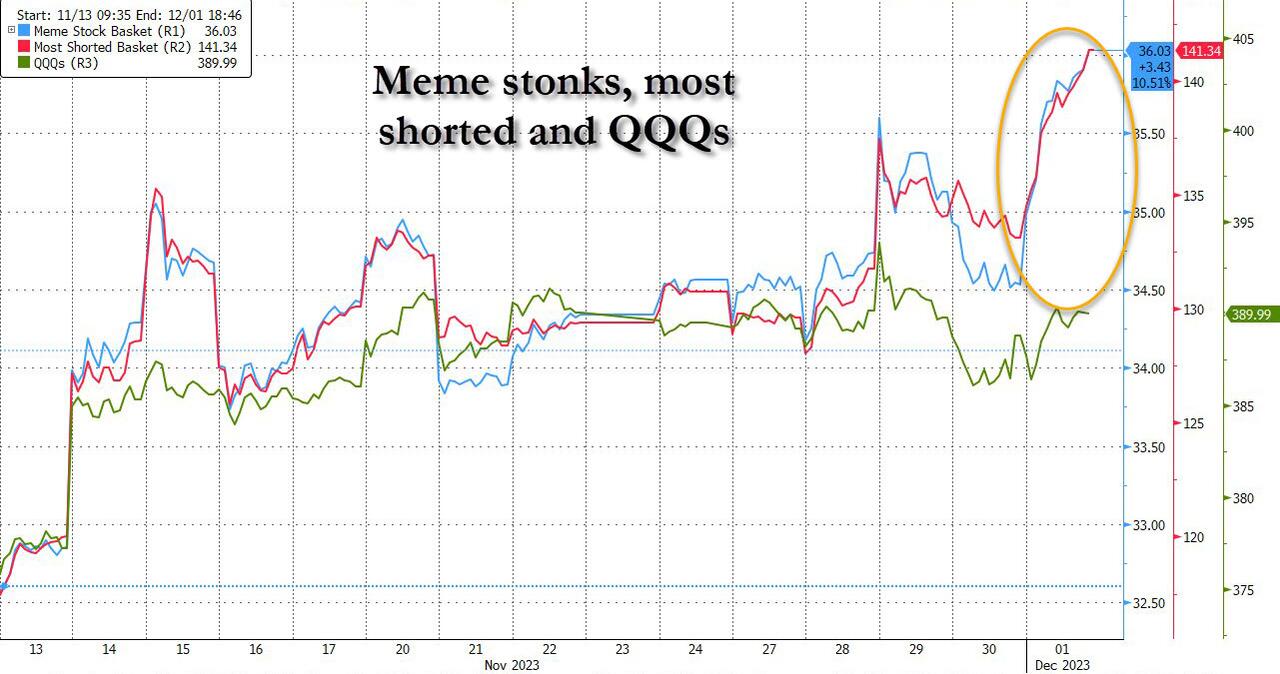

… and one look below the surface reveals that this was indeed the QE trade: the Nasdaq barely rose while meme stonks and most shorted names exploded higher.

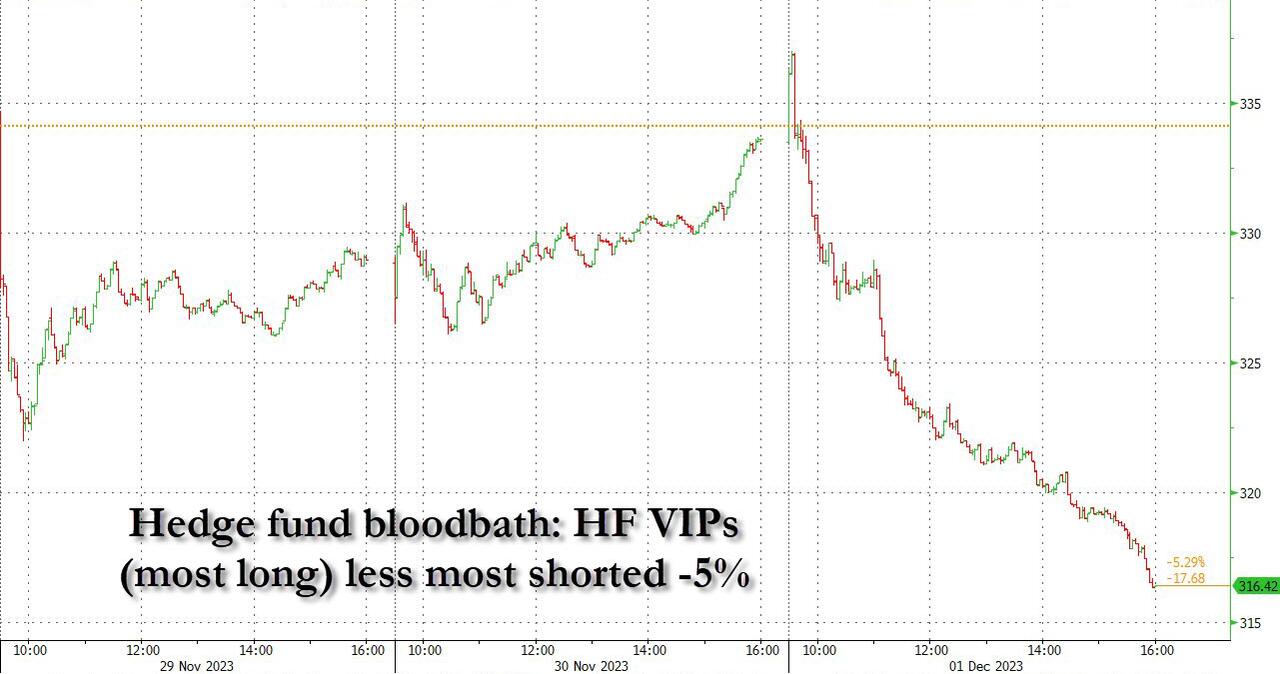

And yet, this eruption in the most shorted/hated names means that hedge funds actually had a catastrophic day: and indeed, looking at the HF VIP (most long) less most shorted basket pair trade we see a whopping 5% drop as many hedge funds were stopped out and margin called.

Putting today’s plunge in contact, this was the worst day for hedge funds since June 2021 and the second worst day since the covid crash!

Next, looking at the bond market, here too everything jumped but especially 2-Year TSYs, whose yields tumbled a whopping 12bps to 4.56%…

… and on course for the biggest weekly slide since the regional banking crisis in March, down almost 40bps.

Yet neither stocks, nor bonds, had quite as much fun as either “digital gold”, with Bitcoin briefly hitting a fresh 2023 high, briefly surging to $39,000 before easing back with Ether rising to $2100 …

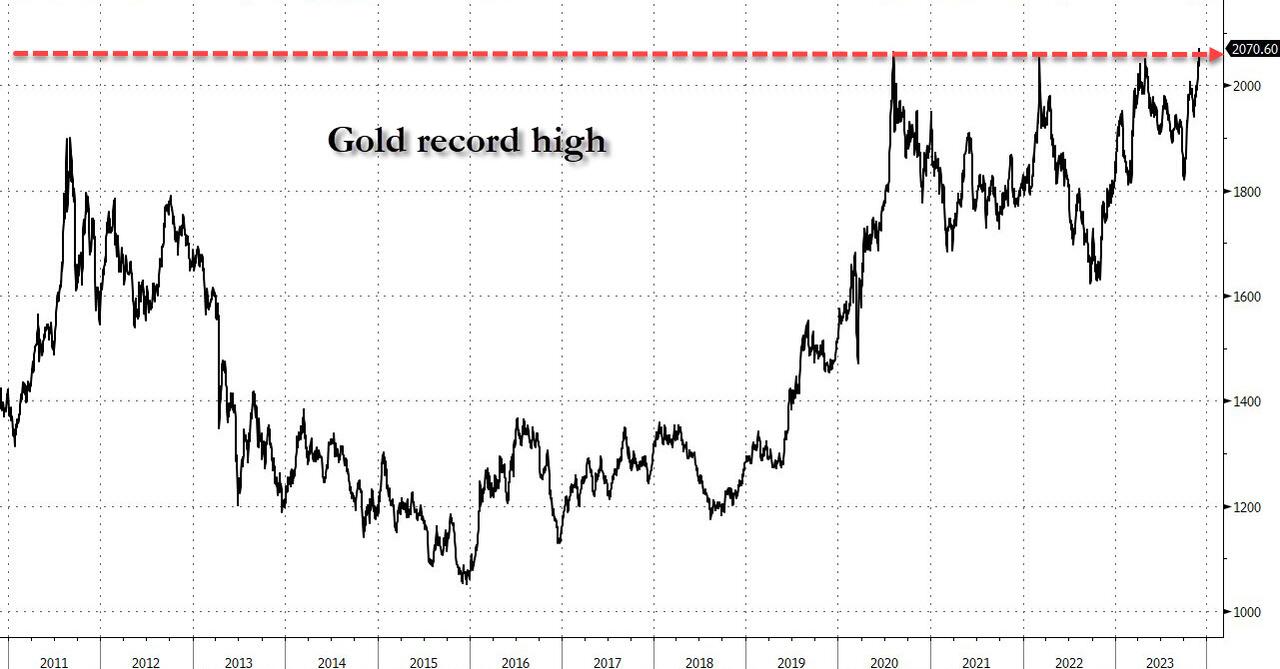

… but the biggest winner by far from today’s market conclusion that a renewed dollar destruction is on deck, was gold which briefly rose above its all time high of $2,075…

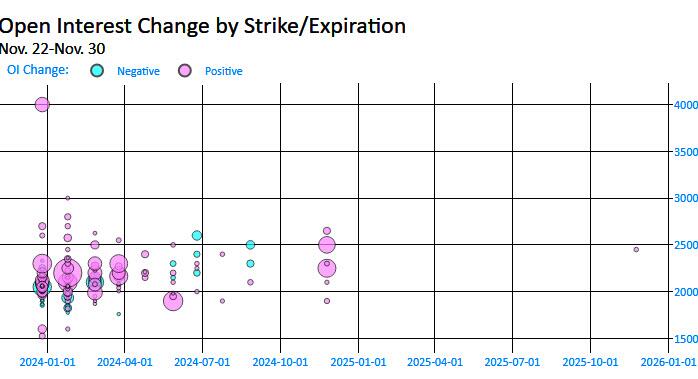

… and that’s just the start: now that a new record is in the history books, a frenzy of gold calls was bought, both for futures and the biggest ETF tied to the metal, and as shown in the chart below, the buildup of open interest between $2,000 and $2,500 has been relentless over the past week on growing optimism that rates are primed to decline. Next up for gold? $2500 or higher.

Yet not everyone had a great day: the dollar predictably tumbled, extending it losses for a third straight week, the longest streak since June, and comes after the dollar saw its worst month in a year this November.

One dollar pair trade where the convexity is especially high is USDJPY, which after soaring for much of the past year suddenly finds itself in a Wile E Coyote moment, trading just below the 100DMA. Should the selling persist, we may see the pair quickly tumble down to 140, or lower.

To be sure, not all the moves made sense: as Bloomberg noted, bonds have a better reason to rally than stocks, which have to factor in the growth concerns that underpin Powell’s remarks. Evidence is gathering that the economy is slowing and stocks will have to reconcile that with their bullish rate views. Today’s ISM Manufacturing data is case in point that the stagflationary slowing that started in October — and Bloomberg Economics says it’s observing typical early signs of recession — extended last month.

Don’t wait for a stock market crash, dedollarization, or CBDCs before securing your retirement with physical precious metals. Genesis Gold Group can help.

The ISM commentary was generally downbeat, equally split between companies hiring and others reducing their labor forces “a first since such comments have been tracked” according to Bloomberg.

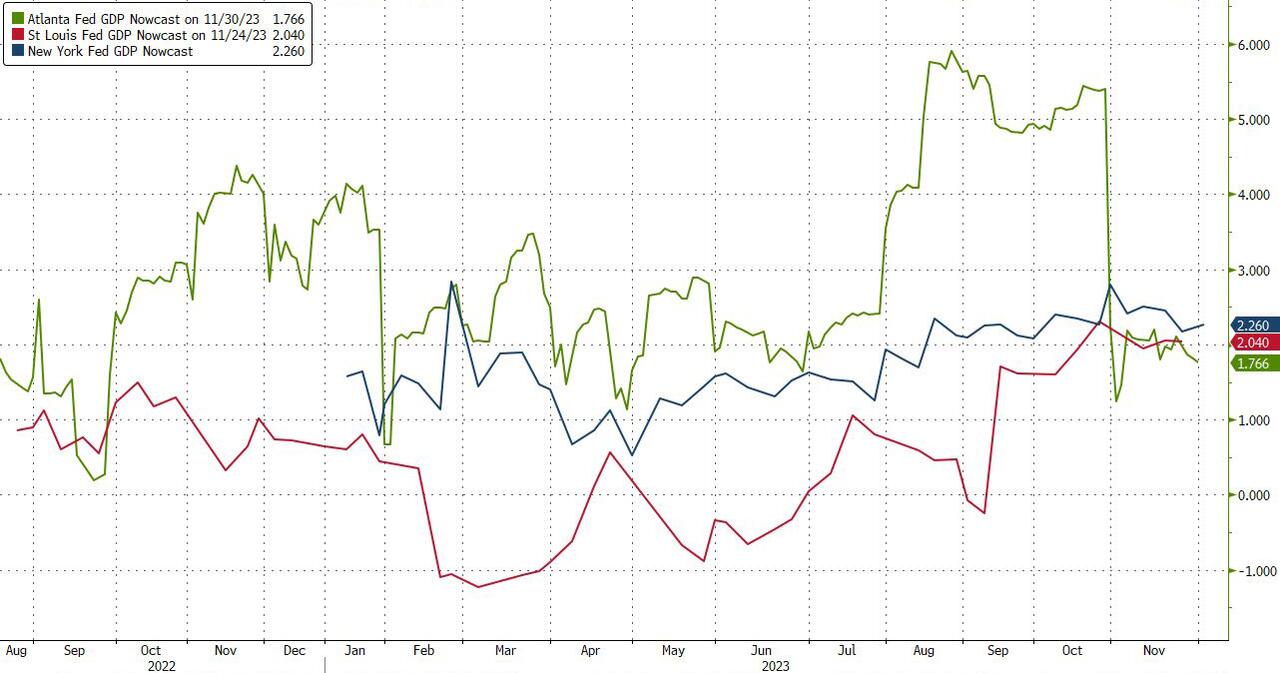

But it gets worse: the latest update to the Atlanta GDPNOW tracker slipped to 1.2% from 1.8% yesterday and over 2% just last week.

And after diverging for much of the year, all three regional Feds that do GDP nowcasts have converged on 2% – a far cry from the “5.2%” GDP print the Biden department of seasonal adjustments goalseeked last month.

Bottom line: the onus is now on the payrolls report next week to further guide markets into next year. The continued rise in ongoing jobless claims pose a risk that unemployment could rise further. But so far, this isn’t a consensus view, with economists projecting the unemployment rate to stay unchanged at 3.9% (and more see a 3.8% rate than 4%).

And while that may only add more fuel to the rate-cut speculation, at some point the softening in economic data will have to be squared with its impact on profits. As a reminder, while much of the interval between the last rate hike and the first rate cut is favorable for risk assets, the weeks right before the cut usually send stocks anywhere between 10% and 30% lower as the market realizes just why the Fed is panicking.

However, judging by today’s action, we still have some time before that particular rude awakening kicks in.

Controlling Protein Is One of the Globalists’ Primary Goals

Between the globalists, corporate interests, and our own government, the food supply is being targeted from multiple angles. It isn’t just silly regulations and misguided subsidies driving natural foods away. Bird flu, sabotaged food processing plants, mysterious deaths of entire cattle herds, arson attacks, and an incessant push to make climate change the primary consideration for all things are combining for a perfect storm to exacerbate the ongoing food crisis.

The primary target is protein. Specifically, they’re going after beef as the environmental boogeyman. They want us eating vegetable-based proteins, lab-grown meat, or even bugs instead of anything that walked the pastures of America. This is why we launched a long-term storage prepper beef company that provides high-quality food that’s shelf-stable for up to 25-years.

At Prepper All-Naturals, we believe Americans should be eating real food today and into the future regardless of what the powers-that-be demand of us. We will never use lab-grown beef. We will never allow our cattle to be injected with mRNA vaccines. We will never bow to the draconian diktats of the climate change cult.

Visit Prepper All-Naturals and use promo code “veterans25” to get 25% off plus free shipping on Ribeye, NY Strip, Tenderloin, and other high-quality cuts of beef. It’s cooked sous vide, then freeze dried and packaged with no other ingredients, just beef. Stock up for the long haul today.