- Watch The JD Rucker Show every day to be truly informed.

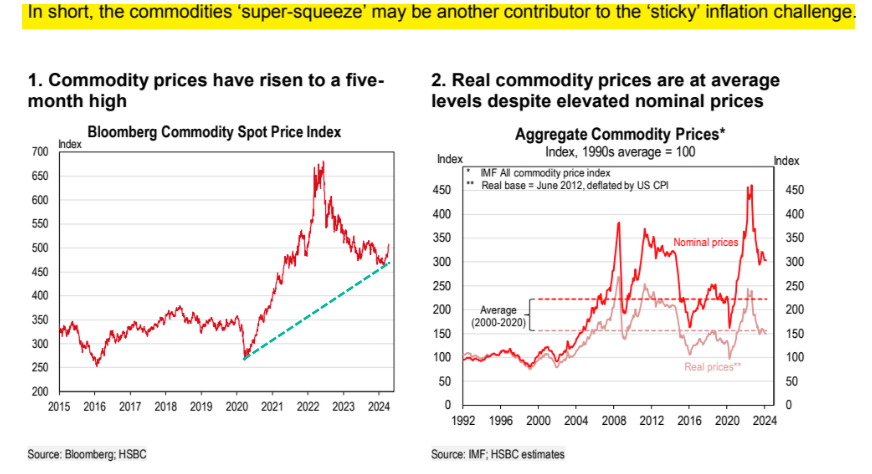

(Zero Hedge)—Commodity prices provide a real-time snapshot of the global economy through spot prices, which are essentially high-frequency data about the current supply and demand environment. These prices are key components in measuring inflation, which has shown signs of easing over the past year. However, a recent surge in the Bloomberg Commodity Index and signs of a reacceleration in US inflation data are troubling for Fed chair Powell.

HSBC’s Paul Bloxham and Jamie Culling asked clients in a note: “Have commodity prices past the trough?”

Their answer, very simply, “It seems likely.”

“Global commodity prices have picked up in recent weeks and could be past the trough,” the analysts said, noting an emerging “weak” upward global industrial cycle has materialized. They continued:

On the demand side, ‘green shoots’ in the global industrial cycle are becoming more apparent. On the supply-side, geopolitical factors are playing an increasingly disruptive role in the ongoing ‘super-squeeze.’

At a deeper level, real commodity prices have already fallen back to their long-run average – that is, the relative prices of commodities to other goods and services are now not unusually high.

So, even if commodity prices only rise in line with other prices from here, they would be passed their trough.

The analysts warned their new machine learning commodity cycle tool is forecasting a “Weak Bull” run, indicating, “If the trough has passed, the recent disinflationary force from falling commodity prices may be done. Central bank observers should take note.”

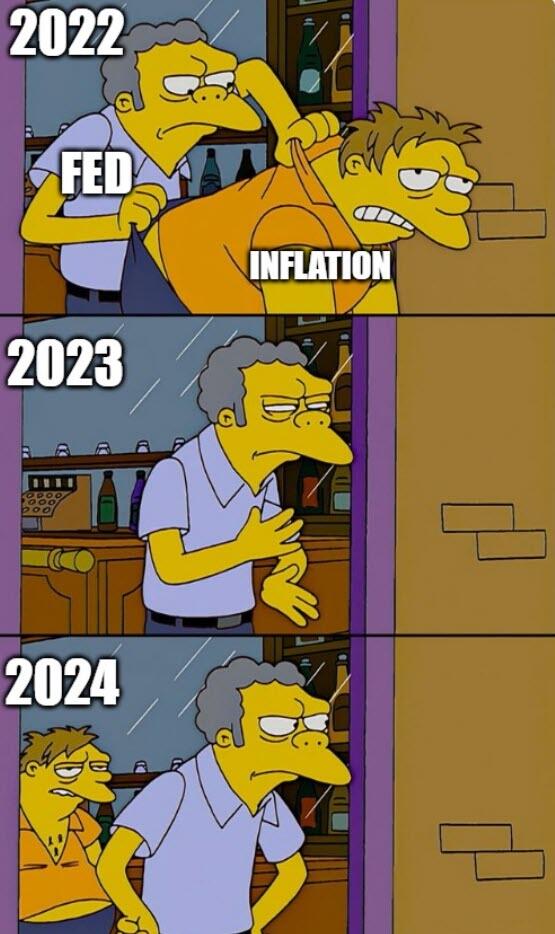

The timing of HSBC’s “Weak Bull” commodity run comes as inflation is reaccelerating in the US. Last week’s March CPI data dump showed a stronger-than-expected 3.5% YoY print, an uptick from the 3.2% YoY rise in February.

Summing up the latest inflation report…

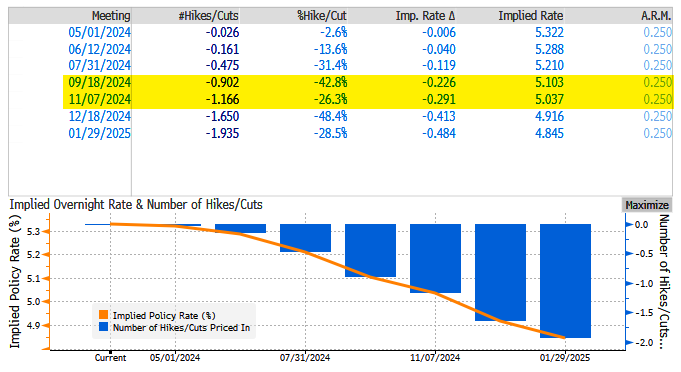

The hot inflation print has pushed rate traders to price in the first 25bps of cuts between September and November. Initially, rate traders were pricing in March cuts.

Hotter-than-expected inflation puts upward pressure on rates and borrowing costs with higher risks of derailing Biden’s reelection odds as Bidenomics fails.

The reacceleration of inflation has Larry MacDonald of The Bear Traps Report warning, “We’re only one event away from a 1970-style stagflation explosion.”

Could the return of the mid-70s inflation storm result from an escalation of the Israel-Iran war where Brent crude soars past $100bbl?

Controlling Protein Is One of the Globalists’ Primary Goals

Between the globalists, corporate interests, and our own government, the food supply is being targeted from multiple angles. It isn’t just silly regulations and misguided subsidies driving natural foods away. Bird flu, sabotaged food processing plants, mysterious deaths of entire cattle herds, arson attacks, and an incessant push to make climate change the primary consideration for all things are combining for a perfect storm to exacerbate the ongoing food crisis.

The primary target is protein. Specifically, they’re going after beef as the environmental boogeyman. They want us eating vegetable-based proteins, lab-grown meat, or even bugs instead of anything that walked the pastures of America. This is why we launched a long-term storage prepper beef company that provides high-quality food that’s shelf-stable for up to 25-years.

At Prepper All-Naturals, we believe Americans should be eating real food today and into the future regardless of what the powers-that-be demand of us. We will never use lab-grown beef. We will never allow our cattle to be injected with mRNA vaccines. We will never bow to the draconian diktats of the climate change cult.

Visit Prepper All-Naturals and use promo code “veterans25” to get 25% off plus free shipping on Ribeye, NY Strip, Tenderloin, and other high-quality cuts of beef. It’s cooked sous vide, then freeze dried and packaged with no other ingredients, just beef. Stock up for the long haul today.