The “forgotten generation,” about 64 million Americans born between 1965 to 1980 and known as Generation X, are unprepared financially for retirement, according to a new study, warning about their “dismal retirement outlook.”

The National Institute on Retirement Security wrote in a report that Generation X was the first generation to enter the labor market following the shift from defined benefit pension plans to 401(k)-style defined contribution accounts.

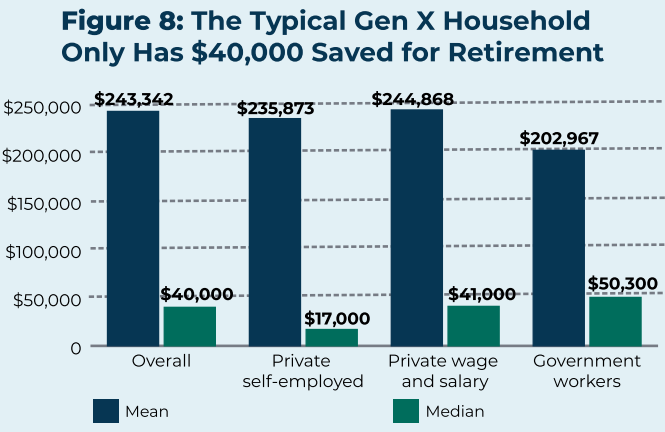

Author of the report and NIRS research director, Tyler Bond, wrote in a statement, “When looking at median retirement savings levels for Generation X, report finds that the bottom half of earners have only a few thousand dollars saved for retirement, and the typical household has only $40,000 in retirement savings.” Shockingly, the study found approximately 40% of the generation have saved not even a single cent towards retirement.

The report relies upon data from the Survey of Income and Program Participation. This nationally representative survey provides income, employment, household composition, and government program participation data. Here are more key findings from the report:

- Slightly more than half (55%) of Gen Xers are participating in an employer-sponsored retirement savings plan.

- Most Gen Xers, regardless of race, gender, marital status, or income, are failing to meet retirement savings targets.

“Most Gen-Xers don’t have a pension plan, they’ve lived through multiple economic crises, wages aren’t keeping up with inflation and costs are rising. The American Dream of retirement is going to be a nightmare for too many Gen-Xers,” NIRS Executive Director Dan Doonan told CBS News.

In June, we cited a separate study that called Generation X, the “Broke Generation,” after a whopping 64% of respondents said they quit saving for retirement not because they didn’t want to but couldn’t afford to.

As for millennials…

Is the American Dream dead? pic.twitter.com/fA8PTCwKos

— Chairman (@WSBChairman) July 16, 2023

Article cross-posted from Zero Hedge.

Controlling Protein Is One of the Globalists’ Primary Goals

Between the globalists, corporate interests, and our own government, the food supply is being targeted from multiple angles. It isn’t just silly regulations and misguided subsidies driving natural foods away. Bird flu, sabotaged food processing plants, mysterious deaths of entire cattle herds, arson attacks, and an incessant push to make climate change the primary consideration for all things are combining for a perfect storm to exacerbate the ongoing food crisis.

The primary target is protein. Specifically, they’re going after beef as the environmental boogeyman. They want us eating vegetable-based proteins, lab-grown meat, or even bugs instead of anything that walked the pastures of America. This is why we launched a long-term storage prepper beef company that provides high-quality food that’s shelf-stable for up to 25-years.

At Prepper All-Naturals, we believe Americans should be eating real food today and into the future regardless of what the powers-that-be demand of us. We will never use lab-grown beef. We will never allow our cattle to be injected with mRNA vaccines. We will never bow to the draconian diktats of the climate change cult.

Visit Prepper All-Naturals and use promo code “veterans25” to get 25% off plus free shipping on Ribeye, NY Strip, Tenderloin, and other high-quality cuts of beef. It’s cooked sous vide, then freeze dried and packaged with no other ingredients, just beef. Stock up for the long haul today.

Read Tyler’s article yesterday (big fan) but as a proud “Boomer” who’s recently retired, I could have told him this long before it went to print. Anyone who’s ever worked alongside the average Gen Xer and beyond can tell you that it’s 1) a question of their priorities and 2) being soft/spoiled generations. The latter isn’t their fault.

Each generation since WWII has gotten softer, as parents tried to make their children’s lives better than the one’s they had growing up. While that sentiment is loving and certainly understandable, they didn’t do their children any favors. Immediate gratification became the standard by which lives were lived and more immediate with each successive generation. Next day air. Easy payment plans.

G. Michael Hopf’s quote tells the story:

Hard times create strong men.

Strong men create good times.

Good time create weak men.

Weak men create hard times.