(Zero Hedge)—Gold prices per ounce surpassed $2,500 USD for the first time ever in August 2024, setting a new all-time high.

The surge in gold value this year has largely been driven by increased central bank demand amidst an increasingly complicated geopolitical and financial landscape. A World Gold Council survey conducted in April 2024 found that 29% of central bank respondents intend to increase their gold reserves in the next 12 months.

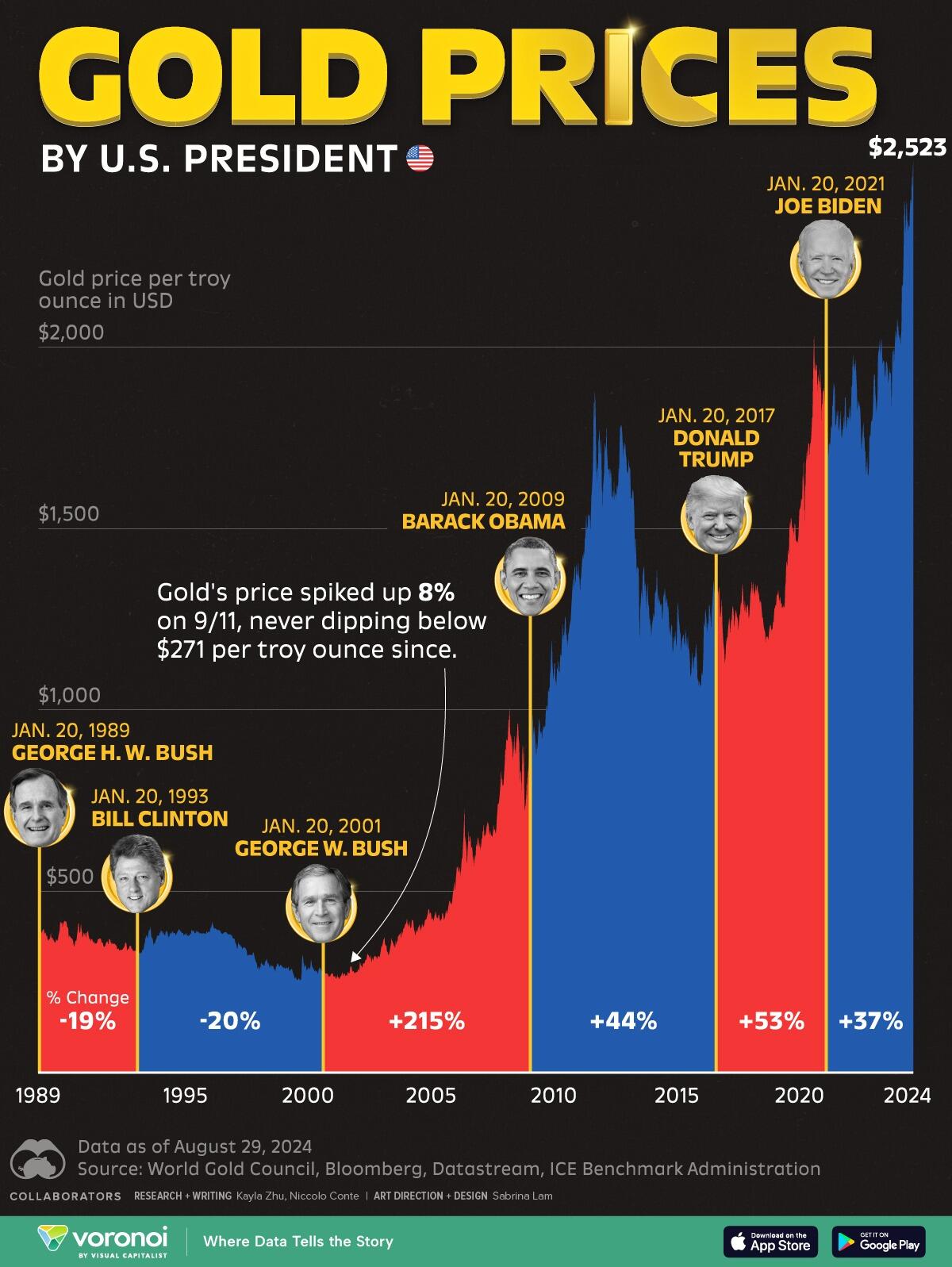

This graphic, via Visual Capitalist’s Kayla Zhu, visualizes the gold price per troy ounce in USD from 1989 to August 29, 2024, with the change in price labeled for each U.S. president’s term.

The figures come from the World Gold Council, who compile price data from ICE Benchmark Administration and the Shanghai Gold Exchange.

*For President Biden, the date of August 29th, 2024 was used for the ending gold price in calculations.

Gold has historically been seen as a safe-haven asset during times of geopolitical uncertainty and economic instability. While gold’s prices increased by over 50% under Trump’s presidency, and by another 37% during Biden’s, the greatest increase of 215% (since 1989) came during George W. Bush’s presidency.

Spurred by the 9/11 attacks and the geopolitical instability which followed, gold’s bull run during Bush’s presidency from 2001 to 2009 could’ve been even greater had the 2008 global financial crisis not occurred. Instead, fear of deflation and a flight to the safety of the U.S. dollar resulted in a 30% dip from the peak to trough of gold prices in 2008.

Events like 9/11, the COVID-19 pandemic, and the Ukraine-Russia war have all contributed to significant increases in gold prices, as investors seek stability during turbulent times.

Whether Donald Trump is reelected or Kamala Harris becomes the first female president of the U.S., Citigroup analysts forecast gold prices exceeding $3,000 by the end of 2024.

To learn more about gold’s recent performance on the markets, check out this graphic that shows the value of a gold bar in various sizes as of August 2024.