Did you know that 2022 was the WORST year for US Treasuries in American history? The benchmark 10-year Treasury fell nearly 18%, and the 30-year Treasury collapsed over 39%. Many other bonds did even worse.

Even if you go back 250 years, you can’t find a worse year for Treasuries, the foundation of the colossal global bond market. It should forever end the ridiculous—yet pervasive—delusion that Treasuries are “risk-free.”

Many people and almost every financial institution have long thoughtlessly accepted this trope. As a result, bonds in general—and Treasuries in particular—became the store-of-value asset of choice and the de facto savings account for savers and investors worldwide.

Today, the global bond market has grown to be worth more than an estimated $133 trillion as the masses parked their savings there because conventional wisdom said it was the “safe” thing to do. By contrast, all the mined gold in the world is worth about $12.7 trillion, less than 10% of the bond market.

It may be tempting to think the worst is over for bonds—it’s not. As you’ll see, the pain for bondholders is just starting. Although most don’t realize it yet, bonds will become a graveyard for capital. They will no longer be the “go-to” savings vehicle because they will no longer be a reliable store-of-value asset.

I believe the opposite will be true; bonds will become a guaranteed way to lose value. Investors will flee them in droves. The implications of that are profound. If not bonds, where will people, companies, and nation states park their savings?

Much of the value stored in the $133 trillion global bond market will move elsewhere—voluntarily to superior store-of-value assets or involuntarily to bankrupt governments and their cronies as they accelerate the largest wealth transfer in history.

That is the Big Picture reality that most people don’t understand… yet. Until recently, bonds had been in a bull market that lasted more than 40 years. Therefore, it’s not surprising that complacency is ingrained and widespread.

The Big Picture

In the post-WWII era, Treasuries were a stable foundation for the global bond market as the US dollar reigned supreme as the world’s premier reserve currency. However, that foundation has rotted. It is on the path to collapse as the petrodollar system falls apart and a multipolar world order emerges.

In short, the supply of Treasuries is increasing at an accelerating rate while there’s a shrinking number of suckers (i.e., buyers).

The inevitable is imminent as the US government can no longer delay or disguise its impending bankruptcy. The US federal government has the biggest debt in the history of the world. And it’s continuing to grow at a rapid, unstoppable pace.

Today, the US federal debt has gone parabolic and is over $32.5 TRILLION. To put that in perspective, if you earned $1 a second 24/7/365—about $31 million per year—it would take you over 1,029,860 YEARS to pay off the US federal debt. And that’s with the unrealistic assumption that it would stop growing.

Observation #1: The US government can’t repay its debt. Default is inevitable.

This isn’t exactly a revelation, but it’s important to remember. Therefore, the question is not whether the US government will default but how. When faced with a choice, politicians always choose the most expedient option. In this case, that means issuing more debt rather than making tough budget decisions or explicitly defaulting.

Consider the recent debt ceiling farce, which raised the debt ceiling for the 105th time since 1944 to avoid an explicit default.

Observation #2: It will not be an explicit default.

In reality, there is no meaningful limit on the debt and spending. Congress is racing towards ever-increasing spending and debt now that they’ve normalized multitrillion-dollar deficits.

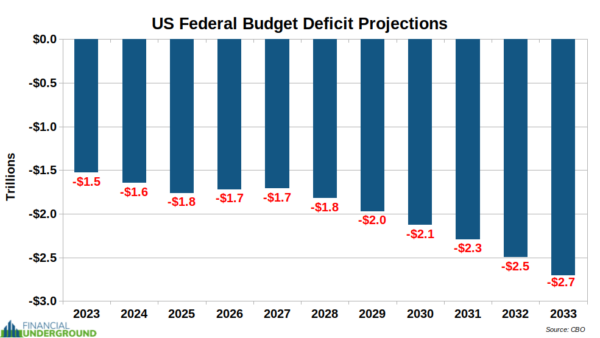

Below is a chart of the Congressional Budget Office’s deficit projections for the next decade. These estimates will almost certainly be too rosy, as they often are.

Even by the CBO’s optimistic projections, the US government will have a cumulative deficit of over $20 TRILLION for the next ten years that will have to be financed by issuing more Treasuries.

Observation #3: The debt will continue to grow at an accelerating pace.

Historically, there has been a vast foreign appetite for Treasuries, but not anymore. In the wake of Russia’s invasion of Ukraine, the US government has launched its most aggressive sanctions campaign ever. As part of this, the US government seized the Russian central bank’s reserves—the nation’s accumulated savings.

It was a stunning illustration of the political risk associated with the US dollar and Treasuries. It showed that the US government could seize another sovereign country’s reserves at the flip of a switch.

In short, the US dollar—and Treasuries—have become weaponized in a way they had not been before. In addition to being terrible investments, Treasuries are now clearly political tools for Washington to coerce others. There could even soon be “woke sanctions”…

For example, the US government recently threatened to sanction Uganda over its LGBT policies, which means that countries’ domestic policies may make them targets of US sanctions.

The rising political risk attached to Treasuries has made them even less attractive as a store of value. Many countries are undoubtedly wondering if the US government will seize their savings if they run afoul with Washington in even the most trivial ways.

China is one of the largest holders of US Treasuries, and it indeed took note of what is happening. There’s little doubt that this is the reason China continues to dump Treasuries. Beijing has sold about 25% of its Treasuries since 2021, an enormous change in such a short period. Even US allies, like Japan, have cut their Treasury holdings.

There are numerous other examples. The bottom line is that it’s clear the world isn’t hungry for US debt right now, at the moment when supply is exploding higher.

Observation #4: Foreigners are not buying as many Treasuries.

In the bond market, when demand for a bond falls, the interest rate rises to entice buyers and holders.

However, it is worth noting that the amount of federal debt is so extreme that even a return of interest rates to their historical average would mean paying an interest expense that would consume more than half of tax revenues. Interest expense would eclipse Social Security and defense spending and become the largest item in the federal budget.

In short, allowing interest rates to rise high enough to entice natural buyers would bankrupt the US government because of the higher interest costs.

Observation #5: The US government cannot allow interest rates to rise much further.

So, if higher interest rates cannot entice more buyers, who will finance these growing multi-trillion dollar budget deficits? The only entity capable is the Federal Reserve, which buys Treasuries with dollars it creates out of thin air.

Observation #6: The Federal Reserve is the only significant buyer of Treasuries stepping up, which means currency debasement.

Here’s the bottom line. The US government can’t pay off its debt. They won’t explicitly default. They can’t entice a meaningful amount of new Treasury buyers by allowing interest rates to rise much higher. Then what can they do?

Financial repression is their only practical option… and it will devastate bondholders. It could all go down soon… and it won’t be pretty. It will result in an enormous wealth transfer from savers to the parasitical class—politicians, central bankers, and those connected to them.

Countless millions throughout history were wiped out financially—or worse—during periods of profound change because they failed to see the correct Big Picture and take appropriate action. Don’t be one of them.

That’s exactly why I just released an urgent new report with all the details, including what you must do to prepare. It’s called, The Most Dangerous Economic Crisis in 100 Years… the Top 3 Strategies You Need Right Now. Click here to download the PDF now.

Article cross-posted from International Man.

I love it people buy debt with debt … you have a dollar . A reserve NOTE . A note is an instrument of debt . You buy a bond . An instrument of debt . You expect wealth in the form of interest . But what do they give you . Dollars for interest . So you use debt to buy debt to get and they give you more of a debt instrument. The principal is returned to you in dollars . It’s still not wealth but debt.

An you expect to get a head . You expect to make wealth . You think bonds can’t fail .

You are an idiot .

Duncan Adams