(DCNF)—The Chinese manufacturer of chemicals for electric vehicle batteries planning to build two U.S. factories has long-standing ties to China’s military industrial complex, a Daily Caller News Foundation investigation found.

Capchem Technology USA, the wholly-owned subsidiary of China-based Shenzhen Capchem Technology (Capchem), plans to build factories in both Ohio and Louisiana that would produce components for electric vehicle batteries. Chinese government documents reveal the Chinese chemical giant was selected over a decade ago to conduct aerospace research for China’s military industrial complex as part of a program overseen by a blacklisted Chinese government agency.

Corporate reports show the company, as recently as 2023, received payments from China’s Ministry of Industry and Information Technology — a government agency spearheading the Chinese government’s so-called “Military-Civil Fusion” efforts.

“This network of [Chinese Communist Party] military-linked companies proliferating across the United States is a great example of why blind economic engagement with China is a national security threat,” Bryan Burack, senior policy advisor for China and the Indo-Pacific at the Heritage Foundation’s Asian Studies Center, told the DCNF.

The DCNF’s investigation is based, in part, on information provided by the Heritage Foundation and Heritage Action.

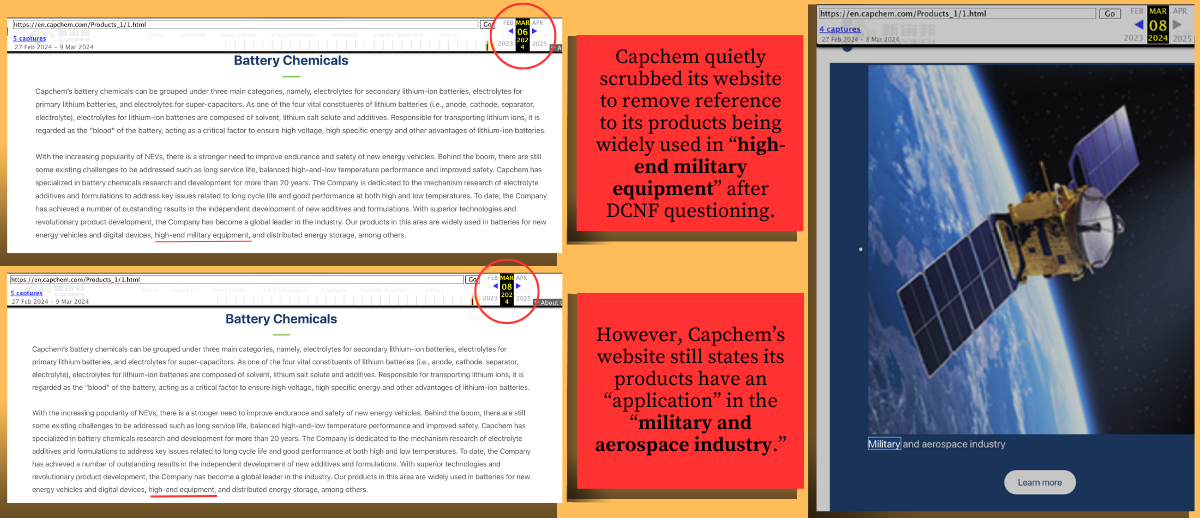

Capchem specializes in manufacturing chemicals for electric vehicle batteries, and for years, the firm has advertised its products’ military uses in annual reports and online. Indeed, until very recently, the firm’s website boldly stated its products were used in “high-end military equipment.”

Yet, Capchem denied supplying the Chinese military, and the reference to “high-end military equipment” was scrubbed from the firm’s website within 24 hours of the DCNF reaching out for comment.

Capchem “does not have products used by Chinese military, or any other military organizations,” a spokesperson told the DCNF.

“When the English/U.S. website was developed, the ‘military’ reference was inadvertently included,” the spokesperson said. “You brought it to the company’s attention, and it was removed just as it had been in the Chinese version in 2020.”

However, the military reference also appeared on Capchem’s Chinese-language website when the DCNF reached out for comment. The reference on Capchem’s Chinese-language site appears to have been removed around the same time as their English-language was being scrubbed.

Capchem business filings and corporate announcements from 2023, along with Chinese financial service research reports from as recent as January 2024, also note the firm’s products had military applications.

Capchem’s work with China’s military industrial complex extends back to at least 2012. That year, the Guangdong province Ministry of Industry and Information Technology announced Capchem was one of 70 companies selected to serve as a “Guangdong Provincial National Defense Science And Technology Industry Military-Civil Fusion Superior Work Unit.”

The work unit focused on “critical components within the aerospace field,” including “space flight-grade, high-reliability and core electronic components, high-end general chips, base software, etcetera,” the 2012 Ministry of Industry and Information Technology announcement reads.

The project was overseen by China’s Administration of Science, Technology and Industry for National Defense, which is “under direct supervision of the Ministry of Industry and Information Technology,” and responsible for “nuclear weapons, aerospace technology, aviation, armament, watercraft and electronic industries,” according to China’s State Council.

China’s “Military-Civil Fusion strategy supports the modernization goals of the People’s Liberation Army by ensuring it can acquire advanced technologies and expertise developed by PRC companies, universities, and research programs that appear to be civilian entities,” according to the U.S. Defense Department.

Chairman of the House Select Committee on the Chinese Communist Party Mike Gallagher of Wisconsin and Ranking Member Raja Krishnamoorthi recently sent a letter to the Treasury and Defense departments noting the U.S. government’s blacklist of Chinese military companies extends to companies working with China’s Ministry of Industry and Information Technology.

“Among other qualifying considerations, a company is a ‘military civil fusion contributor’ if such company is ‘affiliated with the Chinese Ministry of Industry and Information Technology, including research partnerships and projects,’” the lawmakers wrote in January 2024. “The Ministry of Industry and Information Technology was formed in 2008 and is key to the PRC’s military-civil fusion strategy.”

Capchem’s annual reports show the firm has received millions of dollars in payments from the Ministry of Industry and Information Technology since 2017. The ministry paid the firm approximately $1.5 million for an “Industrial Foundation Project” in 2017, according to Capchem’s annual report for that year.

Capchem’s most recent annual report shows the Ministry of Industry and Information Technology had a subsidy of just under $1 million earmarked for the firm at the end of the 2023 mid-term reporting period.

Despite this, Capchem initially denied getting any “money/subsidies/donations from the Chinese government” in an email to the DCNF, though a spokesperson did say the firm had received “economic development tax incentives.”

However, the spokesperson changed their tune when the DCNF pointed to the firm’s own annual reports.

“The last time the company received any Chinese government subsidies besides standard incentives or awards provided for all eligible companies was between 2016 and 2018,” the spokesperson said. “Any reference to subsidies in company reports apply to those received during that time. The company has received no such subsidies since 2018.”

Capchem’s corporate reports list $26 million in subsidies from various Chinese government entities. The company’s 2023 mid-term report lists roughly $10 million worth of new government subsidies in a section labeled “Programs Involving Government Subsidies.”

Heritage’s Burack said Capchem has been “subsidized by the Chinese government” and “manufactures for China’s military.”

“There’s no question who these companies really work for,” Burack said. “There’s no such thing as a private Chinese company.”

‘Aerospace And Military Industries’

Capchem has long advertised the dual military-civilian use for its products. For instance, Capchem’s 2009 annual report touted how the company’s products are used in “aerospace and military industries.”

The vice president of Capchem’s research institute, Liu Zhongbo, discussed the military application of the company’s sodium-ion batteries at a July 2023 battery forum in Jiangsu province.

“Lithium-ion batteries and sodium-ion batteries are representative of new battery types serving as an important foundation for supporting the wide application of new energy sources in the domains of electricity, transportation, communication, military, etcetera,” Liu said during the event, according to Capchem’s website.

“In the future, Capchem will closely follow the national strategy to support the mass production of sodium-ion batteries,” Liu said.

More recently, a January 2024 research report from Chinese financial service firm Huaan Securities identified Capchem’s “fluorinated polyimide” product as being used in the nuclear industry and by the military, and the firm’s “perfluoropolyether oil” product’s use in aerospace landing gear, rudders and aircraft control mechanisms.

‘Security Risks’

Capchem’s plans to expand their U.S. footprint come as federal and state officials move to prohibit the ownership of U.S. land by Chinese entities. Missouri Gov. Mike Parson recently issued an executive order in January 2024 banning entities tied to China from purchasing agricultural land within 10 miles of any “critical military facilities” in the state.

Capchem USA is planning on building an approximately $120 million factory in Lawrence County, Ohio, Capchem announced in June 2023. County commissioners recently approved a 50% tax abatement for Capchem USA’s facility, the Herald Dispatch reported. The facility will serve as a “production facility for the manufacturing of battery chemicals,” according to Capchem.

Capchem USA is also considering a $350 million plant in Louisiana, according to Louisiana Economic Development, a government agency.

Ohio Republican Rep. Brad Wenstrup’s congressional district includes Lawrence County. Barbara Boland, Wenstrup’s press secretary, told the DCNF that the congressman has “warned of the potential security risks to our supply chains, intellectual property and national security posed by Chinese-owned companies operating in the U.S.”

“Congressman Wenstrup recommends local governments and those pursuing economic development opportunities to fully vet any companies seeking to establish a footprint in their communities,” Boland said.

All content created by the Daily Caller News Foundation, an independent and nonpartisan newswire service, is available without charge to any legitimate news publisher that can provide a large audience. All republished articles must include our logo, our reporter’s byline and their DCNF affiliation. For any questions about our guidelines or partnering with us, please contact [email protected].

Controlling Protein Is One of the Globalists’ Primary Goals

Between the globalists, corporate interests, and our own government, the food supply is being targeted from multiple angles. It isn’t just silly regulations and misguided subsidies driving natural foods away. Bird flu, sabotaged food processing plants, mysterious deaths of entire cattle herds, arson attacks, and an incessant push to make climate change the primary consideration for all things are combining for a perfect storm to exacerbate the ongoing food crisis.

The primary target is protein. Specifically, they’re going after beef as the environmental boogeyman. They want us eating vegetable-based proteins, lab-grown meat, or even bugs instead of anything that walked the pastures of America. This is why we launched a long-term storage prepper beef company that provides high-quality food that’s shelf-stable for up to 25-years.

At Prepper All-Naturals, we believe Americans should be eating real food today and into the future regardless of what the powers-that-be demand of us. We will never use lab-grown beef. We will never allow our cattle to be injected with mRNA vaccines. We will never bow to the draconian diktats of the climate change cult.

Visit Prepper All-Naturals and use promo code “veterans25” to get 25% off plus free shipping on Ribeye, NY Strip, Tenderloin, and other high-quality cuts of beef. It’s cooked sous vide, then freeze dried and packaged with no other ingredients, just beef. Stock up for the long haul today.