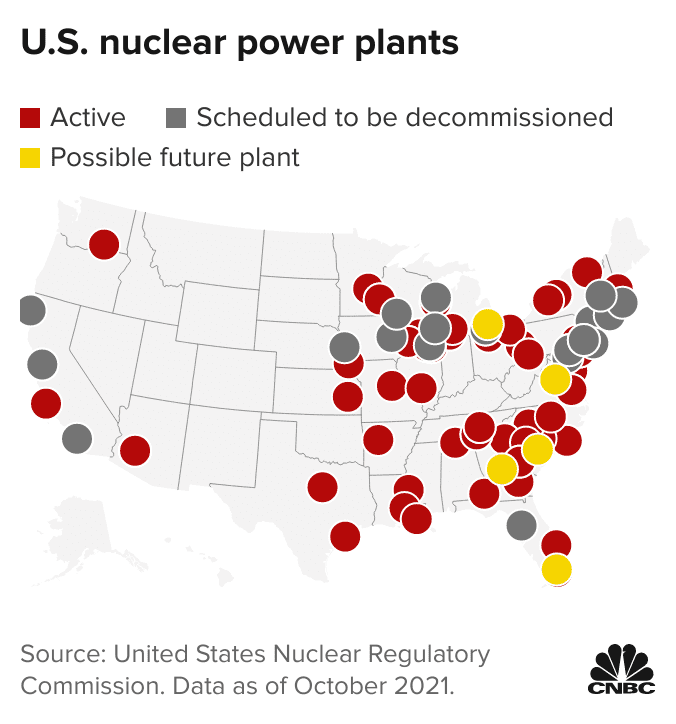

(Zero Hedge)—The United States is about to experience a resurgence in nuclear energy. The federal government is expected to continue restarting shuttered nuclear power plants in the coming years to meet the increasing demand for clean, dependable energy essential for powering the economy of tommorrow.

“There are a couple of nuclear power plants that we probably should, and can, turn back on,” Jigar Shah, director of the US Energy Department’s Loan Programs Office, told Bloomberg in an interview.

In March, Shah’s office approved a loan to Holtec International Corp. to reopen the Palisades nuclear plant in Michigan. This was a historical shift, and it was the first nuclear power plant to be reopened in the US, setting a precedent for atomic energy to make a triumphal comeback. The plant could begin producing power as early as the second half of 2025.

Shah said, “A lot of the other players that have a nuclear power plant that has recently shut down and could be turned back on are gaining that confidence to try.” He declined to give specifics about which plants were slated to reopen.

Nuclear power is the largest single source of carbon-free electricity. Given onshoring trends, electrification of transportation and buildings, and, of course, as we’ve noted in “The Next AI Trade,” the proliferation of AI data centers will overload power grids nationwide unless a significant upgrade is seen.

We again highlighted the enormous investment opportunity early Monday titled “Everyone Is Piling Into The “Next AI Trade””, which lists companies powering up America for the digital age.

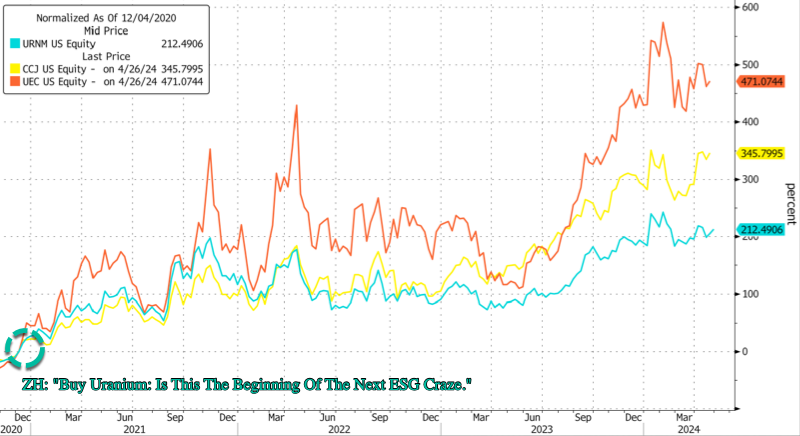

Nearly 3.5 years ago, we provided readers with a straightforward investment thesis: “Buy Uranium: Is This The Beginning Of The Next ESG Craze.” Back then, it became apparent to us that the resurrection of the nuclear power industry was imminent.

And the trend is only gaining steam as the revival of nuclear power plants will continue benefiting some of the largest uranium producers, such as Cameco. We told readers to buy uranium stocks, such as Cameco around the $10 handle – now it’s nearing $50 a share.

As a whole, uranium stocks have soared…

We’ll leave readers with recent comments from Patti Poppe, the chief executive officer of Pacific Gas & Electric.

Poppe told a Stanford University forum that nuclear power should continue to be part of California’s power generation mix as efforts to decarbonize the grid.

“Nuclear should be part of the future,” she said, noting that the state’s only nuclear power plant – Diablo Canyon – could be granted a license extension through the 2030s by the Nuclear Regulatory Commission.

So there it is: Nuclear is being revived at a time when the nation’s grid is nearing a major upgrade due to rising power demand.

It’s becoming increasingly clear that fiat currencies across the globe, including the U.S. Dollar, are under attack. Paper money is losing its value, translating into insane inflation and less value in our life’s savings.

Genesis Gold Group believes physical precious metals are an amazing option for those seeking to move their wealth or retirement to higher ground. Whether Central Bank Digital Currencies replace current fiat currencies or not, precious metals are poised to retain or even increase in value. This is why central banks and mega-asset managers like BlackRock are moving much of their holdings to precious metals.

As a Christian company, Genesis Gold Group has maintained a perfect 5 out of 5 rating with the Better Business Bureau. Their faith-driven values allow them to help Americans protect their life’s savings without the gimmicks used by most precious metals companies. Reach out to them today to see how they can streamline the rollover or transfer of your current and previous retirement accounts.