(Zero Hedge)—At the end of the day, it always winds up reverting to common sense and, in the investing world, alpha.

That’s what has Markus Müller, chief investment officer ESG at Deutsche Bank’s Private Bank, admitting this week that if you want to make money – no matter what you label your fund – you’re likely going to need some exposure to energy and big oil. He also noted the obvious: that big oil companies have, in fact, been making strides to reduce emissions, despite being labeled as serial polluters with ‘more money than God’ by the Biden administration and their cronies.

Reuters dropped a bomb last week when they reported that Müller had stated on Tuesday that sustainability funds should include traditional energy stocks, arguing that not doing so deprives investors of a prime opportunity to invest in the transition to renewable energy.

“When we think about clean energy, these are business models which are quite new and sensitive to interest rates,” he said.

Since the surge in fossil fuel prices following Russia’s invasion of Ukraine in February 2022, fossil fuel stocks have seen significant growth, resulting in environmental, social, and governance (ESG) funds underperforming in comparison.

Müller emphasized that investors focused on sustainability require more detailed disclosures from companies about their shift to lower-carbon operations and clearer regulations for labeling funds concentrating on the transition.

He said that ESG strategies vary, with many funds currently investing in fossil fuels, but impending stricter regulations may lead to more exclusions. For instance, France plans to prohibit ‘ISR’ labeled funds from investing in new fossil fuel projects from 2025. Currently, about 45% of funds, amounting to 7 billion euros, have traditional energy investments.

Deutsche Bank’s Chief Investment Office ESG survey indicates sustained investor interest in sustainability, with energy transition being the top investment choice, surpassing artificial intelligence. However, confidence in ESG factors for risk management is declining, with only 37% agreeing it’s effective, down from previous years.

The survey, with 1,759 mostly European respondents, revealed that just 15% have a solid understanding of ESG, and a mere 3% consider themselves experts.

It’s not surprising, as we have been calling out ESG as a grift since the virtue signaling “trend” was born from the soil of near-unlimited liquidity during the Covid years. Recall, back in August we noted that companies with good ESG scores polluted just as much as those with low ones.

Scientific Beta, an index provider and consultancy, found this summer that companies rated highly on ESG metrics – and even just the ‘Environmental’ variable alone – often pollute just as much as other companies.

Researchers look at ESG scores from Moody’s, MSCI and Refinitiv when performing the analysis. They found that when the ‘E’ component was singled out, it led to a “substantial deterioration in green performance”.

Felix Goltz, research director at Scientific Beta told the Financial Times back in August: “ESG ratings have little to no relation to carbon intensity, even when considering only the environmental pillar of these ratings. It doesn’t seem that people have actually looked at [the correlations]. They are surprisingly low.”

He added: “The carbon intensity reduction of green [ie low carbon intensity] portfolios can be effectively cancelled out by adding ESG objectives.”

Also, let’s not forget about the ‘greenwashing‘ across the ESG industry.

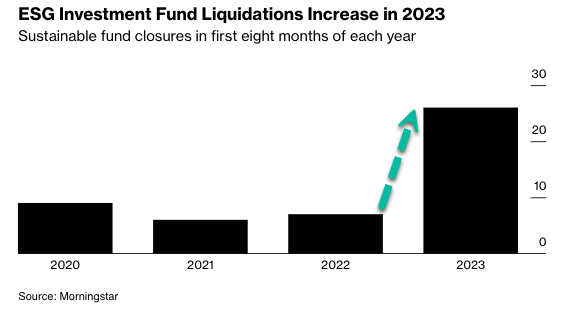

In September, we noted that ESG fund closures in 2023 had surpassed all of the last three years.

Data from Morningstar showed State Street, Columbia Threadneedle Investments, Janus Henderson Group, and Hartford Funds Management Group have unwound more than two dozen ESG funds this year. The latest unwind comes from BlackRock, who told regulators in September it plans to close two ESG emerging-market bond funds with total assets of $55 million.

So far this year, the number of ESG funds closing is more than the last three years combined. This trend comes as investors pull money out of these funds as the ESG bubble has likely popped.

We asked this question in early summer: Is The ESG Investing Boom Already Over?

In January, BlackRock’s Larry Fink told Bloomberg TV at the World Economic Forum in Davos that ESG investing has been tarnished:

“Let’s be clear, the narrative is ugly, the narrative is creating this huge polarization. “

Fink continued:

“We are trying to address the misconceptions. It’s hard because it’s not business any more, they’re doing it in a personal way. And for the first time in my professional career, attacks are now personal. They’re trying to demonize the issues.”

By June, Fink’s BlackRock dropped the term “ESG” following billions of dollars pulled out of its funds by Republican governors, most notably, $2 billion by Florida Gov. Ron DeSantis.

The crux of the issue that Republican lawmakers have with radical ESG funds is that they were trying to impose ‘green’ initiatives on the corporate level to force change in society, and many of these initiatives would be widely unpopular at the ballot box during elections.

Remember these comments from Fink?

Alyssa Stankiewicz, associate director for sustainability research at Morningstar, told Bloomberg, “We have definitely seen demand drop off in 2022 and 2023.”

And hey, don’t say we didn’t warn you; we have been writing about the ESG con for years now…

-

Learn the TRUTH about Gold IRAs and how most precious metals companies play dirty.