Back in August, when discussing Buffett’s ongoing liquidation of his Bank of America stake, we said that “Berkshire’s rising cash stockpiles merely reflect the firm’s inability to find deals in today’s overvalued and weak economic environment”, little did we know just how accurate that would be, because just one day later we and the rest of the market were stunned to learn that far from only dumping Bank of America, the 94-year-old Omaha billionaire had been busy quietly liquidating his most iconic holding in an unprecedented selling spree that sent Berkshire’s cash pile soaring by a record $88 billion to an all time high $277 billion at the end of Q2.

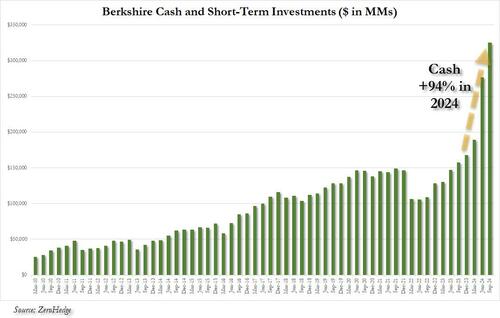

That was just the beginning, however, and this morning we subsequently learned that through the end of Q3, Berkshire’s unprecedented cash build continued, and the world’s largest conglomerate added another $48 billion to its cash – through both “harvesting” (i.e., selling of existing holdings) and cash from operations, taking it to a record $325.2 billion, or nearly a quarter trillion in cash. As shown for context in the chart below, Berkshire has nearly doubled its cash holdings from $168 billion at the start of the year to a staggering $325 billion 9 months later, up 94%!

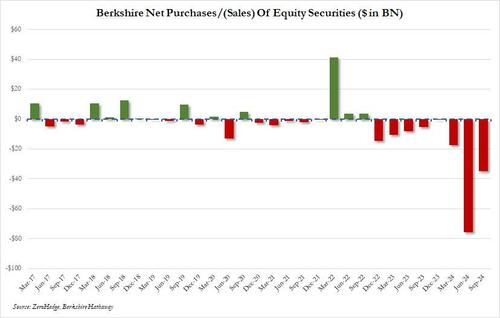

The bulk of the new cash came from sales: in the third quarter, Berkshire sold a net $34.6 billion worth of stock, following the record $75.5 billion in Q2 liquidations, the bulk of which we now know came from Buffett’s sale of half his Apple shares. In other words, the third quarter was the 8th consecutive quarter in which Berkshire has been a net seller of stocks.

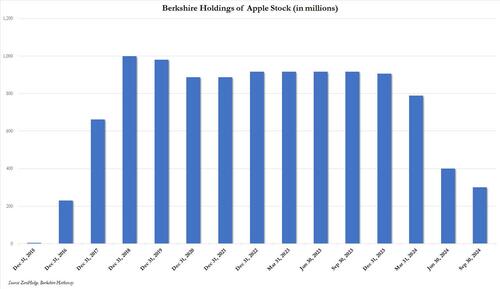

And the selling continued: while there was no 13F filed yet to go with the Berkshire’s 10Q, the company provided a snapshot of its top holdings, revealing that as of Sept 30 it held only $69.9 billion in Apple stock, down a quarter from the $84.2 billion as of June 30, down 62% from $135.4 billion as of March 31 and down 70% from the $174.3 billion as of Dec 31, 2023. This translates into just 300 million shares of AAPL held as of Sept 30, less than a third of what Berkshire owned at the end of 2023, and 30% of Buffett’s peak AAPL holdings of 1 billion shares as of 2018.

Buffett said in May that Apple would likely remain Berkshire’s top holding, indicating that tax issues had motivated the sale. “I don’t mind at all, under current conditions, building the cash position,” he said at the annual shareholder meeting. It was unclear if BRK shareholders understood that to mean a sale of 70% (and rising) of the AAPL holdings. […]

— Read More: www.zerohedge.com

It’s becoming increasingly clear that fiat currencies across the globe, including the U.S. Dollar, are under attack. Paper money is losing its value, translating into insane inflation and less value in our life’s savings.

Genesis Gold Group believes physical precious metals are an amazing option for those seeking to move their wealth or retirement to higher ground. Whether Central Bank Digital Currencies replace current fiat currencies or not, precious metals are poised to retain or even increase in value. This is why central banks and mega-asset managers like BlackRock are moving much of their holdings to precious metals.

As a Christian company, Genesis Gold Group has maintained a perfect 5 out of 5 rating with the Better Business Bureau. Their faith-driven values allow them to help Americans protect their life’s savings without the gimmicks used by most precious metals companies. Reach out to them today to see how they can streamline the rollover or transfer of your current and previous retirement accounts.