(Zero Hedge)—BlackRock chief executive Larry Fink’s efforts to push ‘wokesim’ or environmental, social, and governance policies across corporate America have been in reverse in recent years amid the backlash from Republican lawmakers on Capitol Hill and 19 state attorneys general in conservative states, including Arizona and Texas, who have been fed up with ESG-related policies hurting the economy.

Supposedly, the backlash by anti-woke activists has forced BlackRock to triple Fink’s home security spending. Financial Times says the CEO has become “a target for anti-woke activists and conspiracy theorists.”

According to FT’s numbers, the $10.5 trillion money manager spent $563,513 to “upgrade the home security systems” at Fink’s residences during 2023, on top of $216,837 for bodyguards.

The ESG movement has been highly politicized. Vivek Ramaswamy, one of the Republican party’s presidential candidates before Donald Trump was nominated, called Fink “the king of the woke industrial complex [and] the ESG movement.”

In December, Fink said his firm was unfairly targeted by candidates in the fourth Republican presidential debate, calling it a “sad commentary on the state of American politics.”

Florida Governor Ron DeSantis has called BlackRock the “economic power” to instill a “left-wing agenda.”

Besides conservative lawmakers revolting against the world’s largest woke money manager at the state level and on Capitol Hill, UBS bankers on Wall Street are becoming increasingly frustrated with unrealistic climate goals. Here’s the note, “ESG Frustration And Backlash In The Banking Sector Continues.”

It should be no surprise to our readers: we have been pointing out the demise of ESG for more than a year now. Earlier in March, we wrote how Exxon’s CEO had all but declared victory over the “woke” ESG lobby.

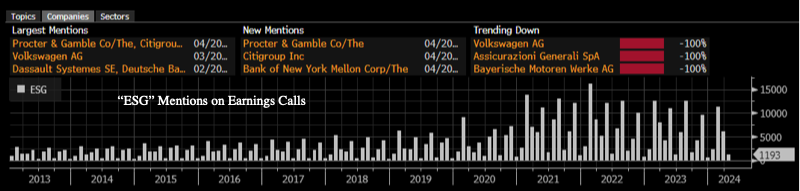

We noted that CEOs were ditching ESG lingo on conference calls in February. For some context, peak ESG and related synonyms, such as “climate change” and “clean energy” and green energy” and net zero,” among other terms, peaked at 28,000 mentions in the first quarter of 2022. Ever since, the number of mentions has plunged.

Fink’s beefing up security is a sign that the political ideology pushed by the asset manager does not align with actual investors and most Americans.

It’s becoming increasingly clear that fiat currencies across the globe, including the U.S. Dollar, are under attack. Paper money is losing its value, translating into insane inflation and less value in our life’s savings.

Genesis Gold Group believes physical precious metals are an amazing option for those seeking to move their wealth or retirement to higher ground. Whether Central Bank Digital Currencies replace current fiat currencies or not, precious metals are poised to retain or even increase in value. This is why central banks and mega-asset managers like BlackRock are moving much of their holdings to precious metals.

As a Christian company, Genesis Gold Group has maintained a perfect 5 out of 5 rating with the Better Business Bureau. Their faith-driven values allow them to help Americans protect their life’s savings without the gimmicks used by most precious metals companies. Reach out to them today to see how they can streamline the rollover or transfer of your current and previous retirement accounts.