The national debt is a political football. Over the last four years, Republicans have proclaimed that the ocean of red ink flooding Washington is an existential threat. In the previous four years, it was the Democrats who rang the IOU alarm bells. A chief tenet of Politics 101 is to worry about the national debt when in opposition and then ignore it upon securing the highest office in the land. Will President-elect Donald Trump be more fiscally responsible than President Joe Biden? What about Trump’s successor in 2029? Whether in war or peace, boom or bust, America’s fiscal health deteriorates.

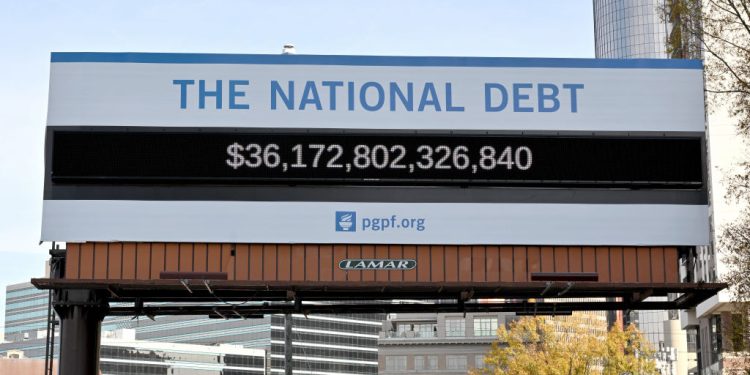

The National Debt Is How Much?

As of December 24, 2024, the national debt stands at $36,146,819,184,367.10. This is broken down into categories: debt held by the public (debt held by individuals, corporations, foreign governments, and the Federal Reserve) and intragovernmental holdings (debts the federal government owes to itself). The former totals $28,839,543,803,673.77, and the latter totals $7,307,275,380,693.33.

Liberty Nation News recently reported that Uncle Sam unlocked three notable milestones this year: $34 trillion, $35 trillion, and $36 trillion. Since January 2, the national debt has climbed nearly $2.2 trillion. Compared to previous years, it’s high, but hardly record breaking. For instance, the debt grew by about $1.858 trillion in 2022 – but it surged about $2.6 trillion in 2023.

The $2 trillion budget shortfalls and the $2 trillion increase in the national debt come as the US government generates near-record revenues, topping $7 trillion. This, of course, supports the common refrain that the nation’s capital does not suffer from a shortage of revenue, but an excess of spending. Indeed, to simplify America’s fiscal mismanagement, the federal government borrows approximately $6 billion per day and spends more than $2 billion every day on interest payments (more on this soon).

According to the Congressional Budget Office’s “An Update to the Budget and Economic Outlook: 2024 to 2034” report in June, the situation will worsen in the coming years. Over the next decade, the national debt is poised to exceed $50 trillion, annual $2 trillion budget deficits are on track to become the norm, and the debt will swallow the entire economy. […]

— Read More: www.libertynation.com