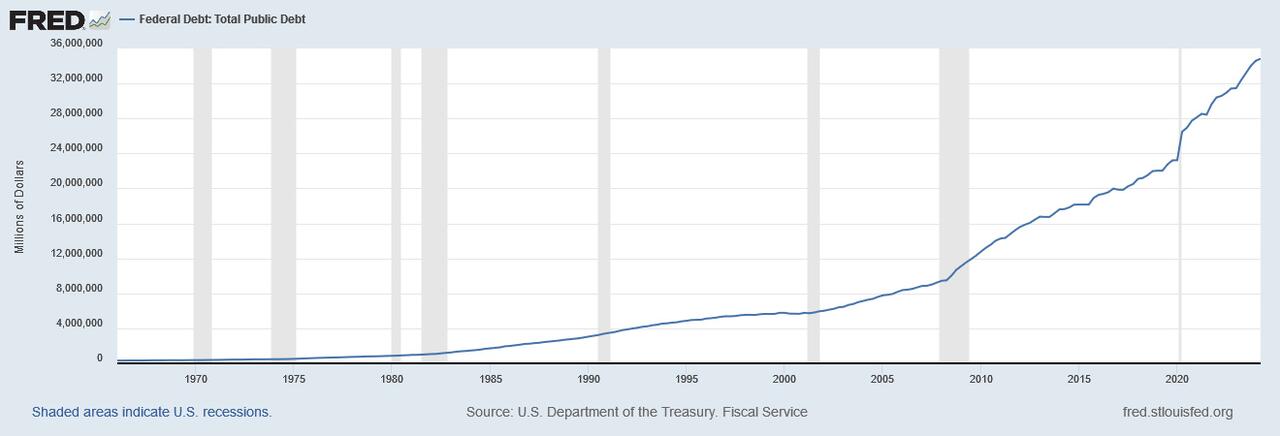

(Zero Hedge)—With soaring deficits, soaring debt, and interest payments that can only be made by issuing a debt-based currency on which even more interest will be due, the USD can only possibly be described as an elaborate nation-state level bankster Ponzi scheme.

Dollars are backed by debt, which requires infinite economic growth to service.

Without constant inflation to erode the debt’s value, transferring wealth from savers to the government and bankers, it all falls apart.

Without new borrowers to sustain current spending, it all falls apart.

Without a petrodollar system where the USD is no longer the world reserve currency, and other countries no longer are forced at gunpoint to use dollars, it all falls apart.

Just as a Ponzi scheme collapses when enough investors lose confidence in it, because there’s no underlying value and not enough new suckers to pay back previous waves of investors, the USD collapses under the same scenario.

And while I see the surface-level, superficial appeal of president-elect Donald Trump’s plan to replace the income tax with tariffs, there’s (at least) one very big problem. We’re in a country that, for decades, hasn’t had a manufacturing base, making the economic viability of the plan incredibly questionable. Even if it somehow worked, it wouldn’t solve the problem of the world’s largest economies being based on glorified, state-sanctioned Ponzi schemes.

Until we revert back to dollars that are pegged to something of real value, like gold, the scam will continue. And it’s gone on for so long that tremendous economic pain is now a prerequisite for weaning ourselves off of it. Just as a Ponzi scheme collapsing harms everyone unlucky enough to be involved, the unwinding of the petrodollar USD Ponzi will hurt every American and, indeed, people all around the world as it reels under the chaos of the realization that the dollar was hollow all along, and the line of new suckers to buy US debt has officially dried up.

With 10-year Treasury yields rising and major pressure on interest rates to go higher, the Fed and Trump are desperate to keep them low. But at $35 trillion, our debt bomb isn’t going away, and the deficit isn’t going anywhere. A heavier interest payment burden and QE are going to blow the USD Ponzi balloon bigger and bigger, so the only question will be when it pops.

Painful as the explosion will be, it’s unavoidable and necessary, and will only be more severe the longer the Ponzi goes on. Just as more investors get hurt, and more spectacularly so, when a Ponzi is able to grow larger, the US dollar collapse will be more painful the longer the can is kicked down the road. This reset will be an opportunity to go back to sound money, but as in the 2008 crisis, the same elites that caused it will try to exploit it as an opportunity to implement an increasingly centralized system that gives them even more control.

Unfortunately, we’re past the event horizon for the Ponzi. Past the point of no return. No amount of economic tinkering, even of the right sort and on a big-enough scale, from Trump or anyone else, can reverse or solve the problem without a major implosion causing terrible pain across the economy. Gold is one way to protect yourself from the fallout, but when it comes crashing down, no one will be immune to the effects of such a spectacular burst.

Controlling Protein Is One of the Globalists’ Primary Goals

Between the globalists, corporate interests, and our own government, the food supply is being targeted from multiple angles. It isn’t just silly regulations and misguided subsidies driving natural foods away. Bird flu, sabotaged food processing plants, mysterious deaths of entire cattle herds, arson attacks, and an incessant push to make climate change the primary consideration for all things are combining for a perfect storm to exacerbate the ongoing food crisis.

The primary target is protein. Specifically, they’re going after beef as the environmental boogeyman. They want us eating vegetable-based proteins, lab-grown meat, or even bugs instead of anything that walked the pastures of America. This is why we launched a long-term storage prepper beef company that provides high-quality food that’s shelf-stable for up to 25-years.

At Prepper All-Naturals, we believe Americans should be eating real food today and into the future regardless of what the powers-that-be demand of us. We will never use lab-grown beef. We will never allow our cattle to be injected with mRNA vaccines. We will never bow to the draconian diktats of the climate change cult.

Visit Prepper All-Naturals and use promo code “veterans25” to get 25% off plus free shipping on Ribeye, NY Strip, Tenderloin, and other high-quality cuts of beef. It’s cooked sous vide, then freeze dried and packaged with no other ingredients, just beef. Stock up for the long haul today.

All I know is that inflation is absolutely devastating for the little guy. It not only constantly diminishes savings, but income tends to severely lag behind. Which is why I don’t see how the government could ever possibly inflate away the debt, if it’s primary tax revenue is tied to income. Since it always lags behind, so will tax revenue. If you want to inflate away the debt, then you’ve got to tie your revenue to something that is up with or ahead of inflation.

No system devised by mankind will ever be perfect. What we’re looking for is the least bad. Everything will have pros and cons. And it’s not exactly like what we’ve been doing the past 50+ years has been working very well.

*its

Seems to me what we’re really looking for is a way to stabilize, and to work toward more stability in a manner that isn’t too abrupt and devastating. And there are many things that could be done that would have a stabilizing influence. Tying revenue to something that is up to speed with inflation may be one way. The gold standard is another. I don’t know. Seems to me the likelihood that we’ll ever go back to the gold standard, or that the federal reserve will ever be done away with, and so on, is between slim and none. In the immediate, we should be looking for ways to do things that will have similar stabilizing influence, but that are not of the marxist/authoritarian/slavery approach to stabilization, wherein the government takes it all, skims its take off the top, and then doles it back out as it sees fit.

I don’t know much of anything about anything, but it seems to me that stabilizing influence is what we’re really talking about. And that it may be possible to achieve similar results, working with existing dynamics, without major changes such as getting rid of the federal reserve or going back onto the gold standard, at least in the short term.

Because it is not necessarily inflation that hurts as much as it is the change of inflation.

Right, you could have a fixed and constant inflation of 30%, but if everything increased at that same rate, at the same speed, then about the only thing needed would be to periodically print bills representing larger amounts of currency.

It’s the change of rate, that puts us behind, and makes it harder and harder for everybody but those who are wealthy enough to hedge it. The more volatile the change, the worse it gets.

Well no, that’s not necessarily the case, because of what it would do to savings.

Pffft, I don’t know what I’m talking about.

I know about enough to know it’s all a confounded mess, and that’s about all I know.