(International Man)—There is only one way to rescue America’s faltering economy and that’s the wholesale abandonment of Washington’s reckless spending, borrowing and printing policies of the last quarter century. These policies did not remotely attain their ostensible goals of more growth, more jobs and more purchasing power in worker pay envelopes. What they did do, of course, was to freight down the main street economy with crushing debts, dangerous financial bubbles, chronic inflation and stagnating living standards.

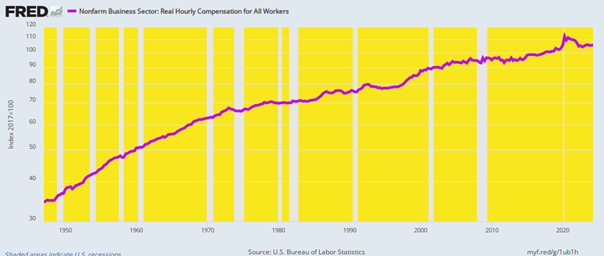

For want of doubt, go straight to the most basic economic metric we have—real compensation per labor hour. The latter metric not only deletes the inflation from the pay figures, but also measures the totality of worker compensation, including benefits for health care, retirement, vacation, disability, sick leave and other fringes.

Needless to say, the purple line below makes crystal clear that historic worker gains have ground to a complete halt.

Per Annum Increase In Real Hourly Compensation:

- Q1 1947 to Q1 2001: +1.79%.

- Q1 2001 To Q1 2020: +0.71%.

- Q1 2020 to Q2 2024: -0.01%.

It doesn’t get any cleaner than this. No matter how the White House, the Fed and the fawning financial press cherry pick the “incoming data” you flat-out can’t say the US economy is “strong” when the growth of the inflation-adjusted pay envelope of 161 million workers has deflated to the vanishing point. Indeed, it has literally been dead in the water for the last 52 months running.

Real Nonfarm Worker Compensation per Hour, 1947 to 2024

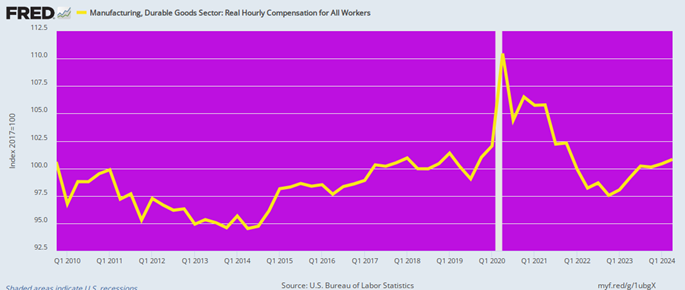

Moreover, the above graph covers all workers, from the bottom to the top end of the wage scale. But when you look at the most recent trends for the highest paid jobs in the durable goods manufacturing sector, the stagnation has been even more dramatic. There has been zero net gain in real compensation per hour in this high-pay sector during the last 15 years; and an obvious contributor to that baleful outcome has been the surge of inflation since 2020 when Washington went off the deep-end with fiscal stimmies and upwards of $5 trillion of newly minted central bank credit.

And we do mean deep-end. During the one-year pandemic stimmy bacchanalia, Washington spent $6.5 trillion on a one-time basis or 150% of the regular Federal budget for war, welfare and everything else as of 2019. At the same time, the Fed printed $5 trillion of new credit during the 30 months between October 2019 and March 2022, which was more than it had printed during the first 106 years of its existence!

In any event, these reckless fiscal and monetary policies had long since caused much of the high productivity, high-pay industrial sector to be off-shored. Yet that happened not because free market capitalism has a death wish in America. It happened because Washington policies generated so much internal cost and nominal wage inflation that vendors of goods to the retail markets had no choice except to source from far lower dollar cost venues abroad, and most especially China and its associated supply chains.

Inflation-Adjusted Compensation in Durable Goods Manufacturing, 2010 to 2024

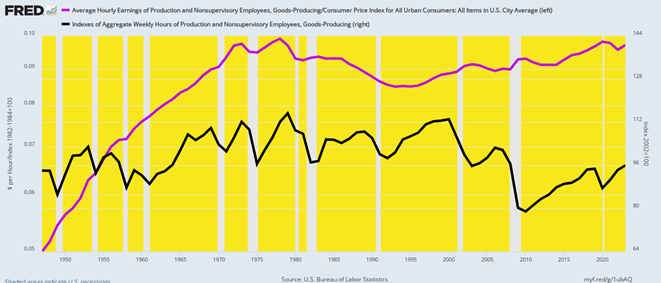

Nor is this just a manufacturing sector issue. The fact is, stagnation and shrinkage has afflicted the entire goods-producing sector of the US economy, including energy production and mining and gas and electric utility production. As shown below, during the heyday of American economic growth after WWII, these sectors were the motor force of prosperity. Between 1947 and 1978:

- Real hourly earnings (purple line) in good-producing doubled, rising by 23% per annum.

- Total hours worked (black line) increased by nearly 20%.

Since that late 1970s peak, however, no cigar with respect to either pay rates or total hours worked. In fact, by 2023–

- Real hourly pay was down by 2% versus 1979, meaning it had stagnated for 45 years!

- Total hours worked were even more debilitated, having been rolled all the way back to the late 1940s level.

That’s right. There were once 24 million high paying jobs in the good-producing sectors, which represented more than 28% of total US employment of 90 million in 1979. But by 2023, total hours worked in the goods-producing sectors have fallen to levels first achieved 75 years earlier.

Goods-Producing Sector: Index Of Real Hourly Wages Versus Index of Total Hours Worked, 1947 to 2023

In light of the above, all of the Biden-Harris palaver about a “strong” economy actually gives the concept of humbug a bad name. Like the claims of the Trump Administration before them, it is based on such egregious manipulation and cherry-picking of the data as to amount to the classic Big Lie, if there ever was one.

The fact is, neither every job counted by the BLS nor every dollar of GDP computed by the Commerce Department is created equal when it comes to economic significance. And it is exactly low pay/low productivity “jobs” and government-fueled “GDP” which has accounted for much of the ballyhooed “strength” of the US economy in recent years and decades.

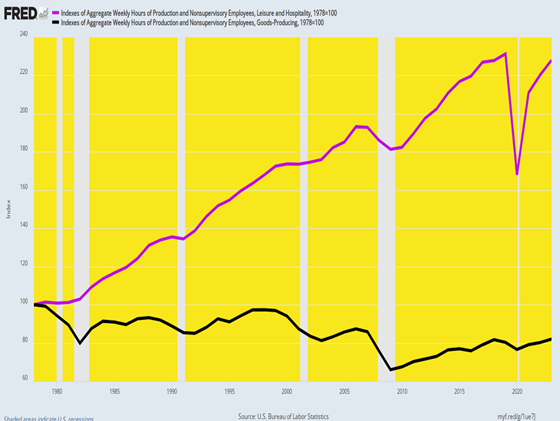

For instance, at the time that good-producing employment peaked in 1979, jobs in the low-pay, minimum wage, episodic employment Leisure & Hospitality sector were just beginning to attain lift-off. During the next 45-years, hours worked in the later sector rose by +128%, even as the index for goods-producing hours per the black lines (both above and below) fell by -18%.

Needless to say, the economic weight of the purple line is only a fraction of that implicated in the black line. For instance, hours worked in the Leisure & Hospitality (L&I) sector average just 23.9 per week and average wages currently stand at $19.66 per hour. This computes to an annual pay equivalent of just $24,400 per L&I “job”.

- Concerned about your life’s savings as the multiple challenges decimate retirement accounts? You’re not alone. Find out how Genesis Precious Metals can help you secure your wealth with a proper self-directed IRA backed by physical precious metals.

By contrast, the equivalent figures for the goods-producing sector are 40.6 hours per week, $31.26 per hour pay rates and an annual equivalent of $66,000 in gross pay. That is to say, in terms of economic throw-weight a L&I “job” is equal to only 37% of a goods-producing “job”.

Index of Total Hours Worked: Leisure & Hospitality Sector Versus Good-Producing, 1978 to 2023

Not surprisingly, therefore, the Biden-Harris claims about 15.9 million jobs “created” on their watch should be taken with a grain of salt.

In the first place, about 9.1 million of these purported new jobs or 58% were actually “born-again jobs”. That is, jobs that were lost during the massive lay-offs triggered by UniParty lockdowns during 2020-2021 that have been subsequently recovered. Specifically, the total nonfarm job count peaked at 152.05 million jobs in February 2020 versus the 158.78 million total posted in August 2024.

So the net gain of 6.73 million jobs is a far cry from the nearly 16 million gain ballyhooed by Biden-Harris, which includes all the born-again ones.

But that’s not the half of it. When you look at the net gain of 6.73 million jobs, only 763,000 or 11% were in the good-producing sector. By contrast, 2.54 million or 38% of the net new jobs on the Biden-Harris Watch were in the low-pay or low productivity L&H, retail, government or private education and health sectors.

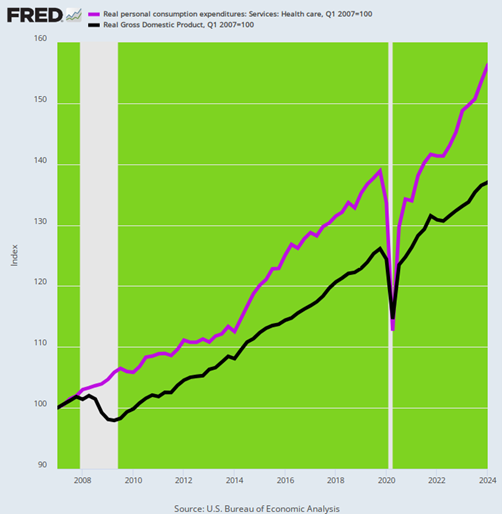

Indeed, these data remind that the GDP numbers reflect the same misleading distortions. Since Q1 2007, for instance, the health care sector has expanded in real terms by 57.4% compared to just 35.7% for the balance of real GDP. Likewise, since Q4 2020, the health care sector has expanded by 17.2% in real terms or nearly double the 9.8% gain for all other components of real GDP.

Then again, the health care sector is overwhelmingly a ward of the state via Medicare/Medicaid and upwards of $300 billion per year in tax subsidies for employer-sponsored health plans. So it’s a case of “if you spend it, it will grow.”

Index Of Real Health Care PCE Versus Total Real GDP, Q1 2007 to Q2 2024

Editor’s Note: The truth is, we’re on the cusp of an economic crisis that could eclipse anything we’ve seen before. And most people won’t be prepared for what’s coming.

That’s exactly why bestselling author Doug Casey and his team just released a free report with all the details on how to survive an economic collapse. Click here to download the PDF now.

What Would You Do If Pharmacies Couldn’t Provide You With Crucial Medications or Antibiotics?

The medication supply chain from China and India is more fragile than ever since Covid. The US is not equipped to handle our pharmaceutical needs. We’ve already seen shortages with antibiotics and other medications in recent months and pharmaceutical challenges are becoming more frequent today.

Our partners at Jase Medical offer a simple solution for Americans to be prepared in case things go south. Their “Jase Case” gives Americans emergency antibiotics they can store away while their “Jase Daily” offers a wide array of prescription drugs to treat the ailments most common to Americans.

They do this through a process that embraces medical freedom. Their secure online form allows board-certified physicians to prescribe the needed drugs. They are then delivered directly to the customer from their pharmacy network. The physicians are available to answer treatment related questions.