Perhaps one of the most bizarre recent developments in economic news has been the attempt by establishment media (and the White House) to declare US inflation “defeated” despite all the facts to the contrary. Keep in mind that when these people talk about inflation, they are only talking about the most recent CPI, which is supposed to be a measure of current inflation growth, not a measure of inflation already accumulated. But, the CPI is easily manipulated, and focus on that index alone is a tactic for misleading the public on the true economic danger.

The way current US inflation is presented might seem like a fiscal miracle. How did America cut CPI so quickly while the rest of the world including Europe is still dealing with continuing distress? Is “Bidenomics” really an economic powerhouse?

No, it’s definitely not. I have addressed this issue in previous articles but I’ll dig into inflation specifically, because I believe a renewed inflationary run is about to spark off in the near term and I suspect the public is being misinformed to keep them unprepared.

First, lets be clear that there are four types of inflation – Creeping, walking, galloping and hyperinflation. We also should distinguish between monetary inflation and price inflation, because they are not always directly related (usually they are, but events outside of money printing can also cause prices to go up).

If we calculate CPI according to the same methods used during the stagflationary crisis of the 1980s, real inflation has been in the double digits for the past couple years. This constitutes galloping inflation, a very dangerous condition that can lead to a depression event.

There are multiple triggers for the inflation spike. The primary cause was tens-of-trillions of dollars in monetary stimulus created by the Federal Reserve, the majority of which took place on the watch of Barack Obama and Joe Biden (there have been multiple GOP Republicans that have also supported these measures, but the majority of dollar devaluation is directly related to Democrat policies). This epic “too big to fail” stimulus created an avalanche effect in which economic weakness accumulated like sheets of ice on a mountainside. The final straw was the covid lockdowns and the $8 trillion+ in stimulus packages pumped directly into the system. Then, it all came crashing down.

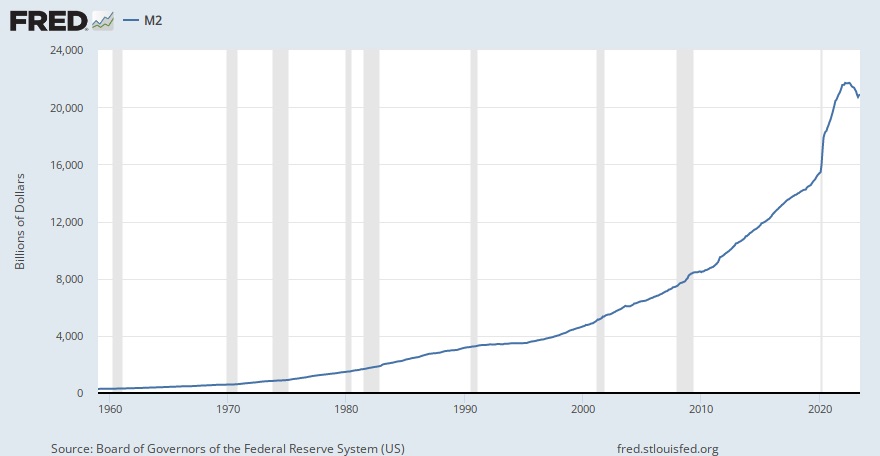

To give you a sense of how bad the situation is, we can take a look at the Fed’s M2 money supply (they stopped reporting the more complete M3 money supply right before the crash of 2008). According to the M2, the amount of dollars in circulation jumped around 40% in the span of only two years. That is an epic amount of money creation and I would argue that the economy still hasn’t processed all of it yet.

There have been too many dollars chasing too few goods and services. Thus, prices rise dramatically, with the cost of necessities increasing by 25%-50%. Think about that for a moment…it now costs us 25%-50% more per year to live than it did before 2020, and it’s not over by a long shot. Houshold costs are still climbing, and since inflation is cumulative we will likely never be rid of the increases that are already in place. But if that’s the reality, why is CPI going down?

The main reason has been the central bank pumping up interest rates. The more expensive debt becomes, the more the economy slows down. That said, the Fed has remained hawkish for a reason; they know that inflation is not going away. They need help if they’re going to convince the public that inflation is no longer a problem.

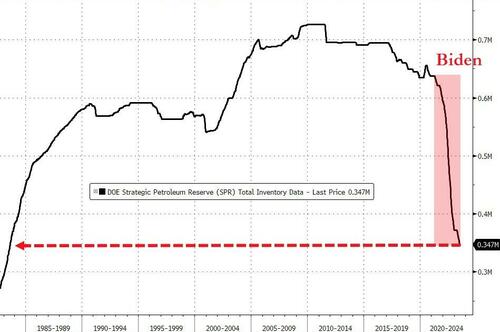

Enter Biden’s scheme of dumping America’s strategic oil reserves on the market as a means to artificially bring down CPI. Energy prices affect almost all other aspects of the CPI index, and when energy costs fall this make it seem like inflation has been tamed. The problem is that it’s a short term fraud. Biden has run out of reserves to dilute the market and the cost of refilling them is going to be exponentially higher. This is why you now see gas prices rising again and they will probably keep rising through the rest of the year.

On top of this there are also geopolitical factors to consider. The White House has earmarked over $100 billion in aid to Ukraine – A proxy war is one good way to circulate fiat dollars overseas as a means to reduce monetary inflation at home, but it’s not going to be enough unless the war expands considerably. Then there is the problem of export disruptions.

For example, Russia is now officially and aggressively shutting down Ukraine’s wheat and grain exports, which is going to cause another price spike in wheat and all foods that use wheat. India just shut down major exports of rice to protect their domestic supply, meaning rice is going to rocket in price. And, there’s an overall trend of foriegn creditors quietly dumping the US dollar as the world reserve currency. All those dollars will eventually make their way back to the US, meaning an even larger money supply circulating domestically with higher inflation as a result.

The Fed doesn’t necessarily have to keep printing for inflation to persist, they just had to set the chain reaction in motion. The recent Fitch downgrade of the US credit rating is not going to help matters as it encourages foreign investors to dump the dollar and treasuries even faster.

To be sure, there is still the matter of the battle between deflationary factors vs inflationary factors. In October, the last vestiges of covid stimlus measures will finally die, including the moratorium on student loan debt payments – That’s trillions of dollars of loans pulling billions in payments each year.

Not only that, but when those loans were put on hold, millions of people magically had their credit ratings rise, which means they had access to higher credit card limits and a vast pool of debt. Now, that’s all going away, too. No more living off Visa and Mastercard means US retail is about to take a considerable hit along with the jobs market.

Then there’s the Fed’s interest rate hikes which are now about as high as they were right before the crash of 2008. The same hikes that helped cause the spring banking crisis (which is also not over). The US will be paying record interest on the national debt, consumers will be using far less credit and banks will be lending less and less money.

So yes, there will be competing forces pulling the economy in two different directions: Inflation and deflation. However, I would argue that inflation is not done with us yet and that the Fed will have to hike a few more times to suppress it in the short term. In the long term, the viability of the US dollar is the issue, but that’s a discussion for another article…

Article cross-posted from Alt-Market.

- Concerned about your life’s savings as the multiple challenges decimate retirement accounts? You’re not alone. Find out how Genesis Precious Metals can help you secure your wealth with a proper self-directed IRA backed by physical precious metals.

Controlling Protein Is One of the Globalists’ Primary Goals

Between the globalists, corporate interests, and our own government, the food supply is being targeted from multiple angles. It isn’t just silly regulations and misguided subsidies driving natural foods away. Bird flu, sabotaged food processing plants, mysterious deaths of entire cattle herds, arson attacks, and an incessant push to make climate change the primary consideration for all things are combining for a perfect storm to exacerbate the ongoing food crisis.

The primary target is protein. Specifically, they’re going after beef as the environmental boogeyman. They want us eating vegetable-based proteins, lab-grown meat, or even bugs instead of anything that walked the pastures of America. This is why we launched a long-term storage prepper beef company that provides high-quality food that’s shelf-stable for up to 25-years.

At Prepper All-Naturals, we believe Americans should be eating real food today and into the future regardless of what the powers-that-be demand of us. We will never use lab-grown beef. We will never allow our cattle to be injected with mRNA vaccines. We will never bow to the draconian diktats of the climate change cult.

Visit Prepper All-Naturals and use promo code “veterans25” to get 25% off plus free shipping on Ribeye, NY Strip, Tenderloin, and other high-quality cuts of beef. It’s cooked sous vide, then freeze dried and packaged with no other ingredients, just beef. Stock up for the long haul today.

Dear Brandon Smith,

It never left.

Folgers coffee small tin 9.95 to 12.95 +30.1%

Steel stock fence 89.95 to 129.95 +40%

Gas Trimmer blade 5 point for weed whacking 15.95 to 44.00 +175%

All of these in less than three years under Biden.

I would say whatever the administration and financial gurus are telling us are lies, inflation is rampant.