Did you know that 2022 was the WORST year for US Treasuries in American history? The benchmark 10-year Treasury fell nearly 18%, and the 30-year Treasury collapsed over 39%. Many other bonds did even worse.

Even if you go back 250 years, you can’t find a worse year for Treasuries, the foundation of the colossal global bond market. It should forever end the ridiculous—yet pervasive—delusion that Treasuries are “risk-free.”

Many people and almost every financial institution have long thoughtlessly accepted this trope. As a result, bonds in general—and Treasuries in particular—became the store-of-value asset of choice and the de facto savings account for savers and investors worldwide.

Today, the global bond market has grown to be worth more than an estimated $133 trillion as the masses parked their savings there because conventional wisdom said it was the “safe” thing to do. By contrast, all the mined gold in the world is worth about $12.7 trillion, less than 10% of the bond market.

It may be tempting to think the worst is over for bonds—it’s not. As you’ll see, the pain for bondholders is just starting. Although most don’t realize it yet, bonds will become a graveyard for capital. They will no longer be the “go-to” savings vehicle because they will no longer be a reliable store-of-value asset.

I believe the opposite will be true; bonds will become a guaranteed way to lose value. Investors will flee them in droves. The implications of that are profound. If not bonds, where will people, companies, and nation states park their savings?

Much of the value stored in the $133 trillion global bond market will move elsewhere—voluntarily to superior store-of-value assets or involuntarily to bankrupt governments and their cronies as they accelerate the largest wealth transfer in history.

That is the Big Picture reality that most people don’t understand… yet. Until recently, bonds had been in a bull market that lasted more than 40 years. Therefore, it’s not surprising that complacency is ingrained and widespread.

The Big Picture

In the post-WWII era, Treasuries were a stable foundation for the global bond market as the US dollar reigned supreme as the world’s premier reserve currency. However, that foundation has rotted. It is on the path to collapse as the petrodollar system falls apart and a multipolar world order emerges.

In short, the supply of Treasuries is increasing at an accelerating rate while there’s a shrinking number of suckers (i.e., buyers).

The inevitable is imminent as the US government can no longer delay or disguise its impending bankruptcy. The US federal government has the biggest debt in the history of the world. And it’s continuing to grow at a rapid, unstoppable pace.

Today, the US federal debt has gone parabolic and is over $32.5 TRILLION. To put that in perspective, if you earned $1 a second 24/7/365—about $31 million per year—it would take you over 1,029,860 YEARS to pay off the US federal debt. And that’s with the unrealistic assumption that it would stop growing.

Observation #1: The US government can’t repay its debt. Default is inevitable.

This isn’t exactly a revelation, but it’s important to remember. Therefore, the question is not whether the US government will default but how. When faced with a choice, politicians always choose the most expedient option. In this case, that means issuing more debt rather than making tough budget decisions or explicitly defaulting.

Consider the recent debt ceiling farce, which raised the debt ceiling for the 105th time since 1944 to avoid an explicit default.

Observation #2: It will not be an explicit default.

In reality, there is no meaningful limit on the debt and spending. Congress is racing towards ever-increasing spending and debt now that they’ve normalized multitrillion-dollar deficits.

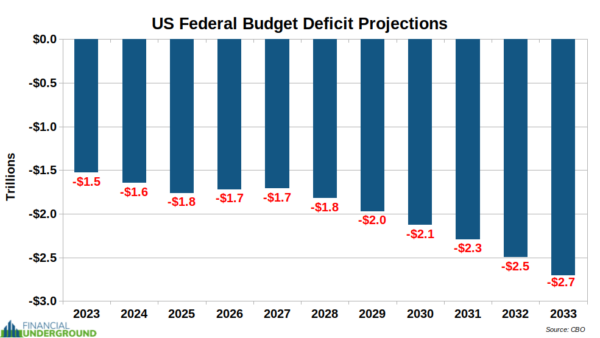

Below is a chart of the Congressional Budget Office’s deficit projections for the next decade. These estimates will almost certainly be too rosy, as they often are.

Even by the CBO’s optimistic projections, the US government will have a cumulative deficit of over $20 TRILLION for the next ten years that will have to be financed by issuing more Treasuries.

Observation #3: The debt will continue to grow at an accelerating pace.

Historically, there has been a vast foreign appetite for Treasuries, but not anymore. In the wake of Russia’s invasion of Ukraine, the US government has launched its most aggressive sanctions campaign ever. As part of this, the US government seized the Russian central bank’s reserves—the nation’s accumulated savings.

It was a stunning illustration of the political risk associated with the US dollar and Treasuries. It showed that the US government could seize another sovereign country’s reserves at the flip of a switch.

In short, the US dollar—and Treasuries—have become weaponized in a way they had not been before. In addition to being terrible investments, Treasuries are now clearly political tools for Washington to coerce others. There could even soon be “woke sanctions”…

For example, the US government recently threatened to sanction Uganda over its LGBT policies, which means that countries’ domestic policies may make them targets of US sanctions.

The rising political risk attached to Treasuries has made them even less attractive as a store of value. Many countries are undoubtedly wondering if the US government will seize their savings if they run afoul with Washington in even the most trivial ways.

China is one of the largest holders of US Treasuries, and it indeed took note of what is happening. There’s little doubt that this is the reason China continues to dump Treasuries. Beijing has sold about 25% of its Treasuries since 2021, an enormous change in such a short period. Even US allies, like Japan, have cut their Treasury holdings.

There are numerous other examples. The bottom line is that it’s clear the world isn’t hungry for US debt right now, at the moment when supply is exploding higher.

Observation #4: Foreigners are not buying as many Treasuries.

In the bond market, when demand for a bond falls, the interest rate rises to entice buyers and holders.

However, it is worth noting that the amount of federal debt is so extreme that even a return of interest rates to their historical average would mean paying an interest expense that would consume more than half of tax revenues. Interest expense would eclipse Social Security and defense spending and become the largest item in the federal budget.

In short, allowing interest rates to rise high enough to entice natural buyers would bankrupt the US government because of the higher interest costs.

Observation #5: The US government cannot allow interest rates to rise much further.

So, if higher interest rates cannot entice more buyers, who will finance these growing multi-trillion dollar budget deficits? The only entity capable is the Federal Reserve, which buys Treasuries with dollars it creates out of thin air.

Observation #6: The Federal Reserve is the only significant buyer of Treasuries stepping up, which means currency debasement.

Here’s the bottom line. The US government can’t pay off its debt. They won’t explicitly default. They can’t entice a meaningful amount of new Treasury buyers by allowing interest rates to rise much higher. Then what can they do?

Financial repression is their only practical option… and it will devastate bondholders. It could all go down soon… and it won’t be pretty. It will result in an enormous wealth transfer from savers to the parasitical class—politicians, central bankers, and those connected to them.

Countless millions throughout history were wiped out financially—or worse—during periods of profound change because they failed to see the correct Big Picture and take appropriate action. Don’t be one of them.

That’s exactly why I just released an urgent new report with all the details, including what you must do to prepare. It’s called, The Most Dangerous Economic Crisis in 100 Years… the Top 3 Strategies You Need Right Now. Click here to download the PDF now.

Article cross-posted from International Man.

Five Things New “Preppers” Forget When Getting Ready for Bad Times Ahead

The preparedness community is growing faster than it has in decades. Even during peak times such as Y2K, the economic downturn of 2008, and Covid, the vast majority of Americans made sure they had plenty of toilet paper but didn’t really stockpile anything else.

Things have changed. There’s a growing anxiety in this presidential election year that has prompted more Americans to get prepared for crazy events in the future. Some of it is being driven by fearmongers, but there are valid concerns with the economy, food supply, pharmaceuticals, the energy grid, and mass rioting that have pushed average Americans into “prepper” mode.

There are degrees of preparedness. One does not have to be a full-blown “doomsday prepper” living off-grid in a secure Montana bunker in order to be ahead of the curve. In many ways, preparedness isn’t about being able to perfectly handle every conceivable situation. It’s about being less dependent on government for as long as possible. Those who have proper “preps” will not be waiting for FEMA to distribute emergency supplies to the desperate masses.

Below are five things people new to preparedness (and sometimes even those with experience) often forget as they get ready. All five are common sense notions that do not rely on doomsday in order to be useful. It may be nice to own a tank during the apocalypse but there’s not much you can do with it until things get really crazy. The recommendations below can have places in the lives of average Americans whether doomsday comes or not.

Note: The information provided by this publication or any related communications is for informational purposes only and should not be considered as financial advice. We do not provide personalized investment, financial, or legal advice.

Secured Wealth

Whether in the bank or held in a retirement account, most Americans feel that their life’s savings is relatively secure. At least they did until the last couple of years when de-banking, geopolitical turmoil, and the threat of Central Bank Digital Currencies reared their ugly heads.

It behooves Americans to diversify their holdings. If there’s a triggering event or series of events that cripple the financial systems or devalue the U.S. Dollar, wealth can evaporate quickly. To hedge against potential turmoil, many Americans are looking in two directions: Crypto and physical precious metals.

There are huge advantages to cryptocurrencies, but there are also inherent risks because “virtual” money can become challenging to spend. Add in the push by central banks and governments to regulate or even replace cryptocurrencies with their own versions they control and the risks amplify. There’s nothing wrong with cryptocurrencies today but things can change rapidly.

As for physical precious metals, many Americans pay cash to keep plenty on hand in their safe. Rolling over or transferring retirement accounts into self-directed IRAs is also a popular option, but there are caveats. It can often take weeks or even months to get the gold and silver shipped if the owner chooses to close their account. This is why Genesis Gold Group stands out. Their relationship with the depositories allows for rapid closure and shipping, often in less than 10 days from the time the account holder makes their move. This can come in handy if things appear to be heading south.

Lots of Potable Water

One of the biggest shocks that hit new preppers is understanding how much potable water they need in order to survive. Experts claim one gallon of water per person per day is necessary. Even the most conservative estimates put it at over half-a-gallon. That means that for a family of four, they’ll need around 120 gallons of water to survive for a month if the taps turn off and the stores empty out.

Being near a fresh water source, whether it’s a river, lake, or well, is a best practice among experienced preppers. It’s necessary to have a water filter as well, even if the taps are still working. Many refuse to drink tap water even when there is no emergency. Berkey was our previous favorite but they’re under attack from regulators so the Alexapure systems are solid replacements.

For those in the city or away from fresh water sources, storage is the best option. This can be challenging because proper water storage containers take up a lot of room and are difficult to move if the need arises. For “bug in” situations, having a larger container that stores hundreds or even thousands of gallons is better than stacking 1-5 gallon containers. Unfortunately, they won’t be easily transportable and they can cost a lot to install.

Water is critical. If chaos erupts and water infrastructure is compromised, having a large backup supply can be lifesaving.

Pharmaceuticals and Medical Supplies

There are multiple threats specific to the medical supply chain. With Chinese and Indian imports accounting for over 90% of pharmaceutical ingredients in the United States, deteriorating relations could make it impossible to get the medicines and antibiotics many of us need.

Stocking up many prescription medications can be hard. Doctors generally do not like to prescribe large batches of drugs even if they are shelf-stable for extended periods of time. It is a best practice to ask your doctor if they can prescribe a larger amount. Today, some are sympathetic to concerns about pharmacies running out or becoming inaccessible. Tell them your concerns. It’s worth a shot. The worst they can do is say no.

If your doctor is unwilling to help you stock up on medicines, then Jase Medical is a good alternative. Through telehealth, they can prescribe daily meds or antibiotics that are shipped to your door. As proponents of medical freedom, they empathize with those who want to have enough medical supplies on hand in case things go wrong.

Energy Sources

The vast majority of Americans are locked into the grid. This has proven to be a massive liability when the grid goes down. Unfortunately, there are no inexpensive remedies.

Those living off-grid had to either spend a lot of money or effort (or both) to get their alternative energy sources like solar set up. For those who do not want to go so far, it’s still a best practice to have backup power sources. Diesel generators and portable solar panels are the two most popular, and while they’re not inexpensive they are not out of reach of most Americans who are concerned about being without power for extended periods of time.

Natural gas is another necessity for many, but that’s far more challenging to replace. Having alternatives for heating and cooking that can be powered if gas and electric grids go down is important. Have a backup for items that require power such as manual can openers. If you’re stuck eating canned foods for a while and all you have is an electric opener, you’ll have problems.

Don’t Forget the Protein

When most think about “prepping,” they think about their food supply. More Americans are turning to gardening and homesteading as ways to produce their own food. Others are working with local farmers and ranchers to purchase directly from the sources. This is a good idea whether doomsday comes or not, but it’s particularly important if the food supply chain is broken.

Most grocery stores have about one to two weeks worth of food, as do most American households. Grocers rely heavily on truckers to receive their ongoing shipments. In a crisis, the current process can fail. It behooves Americans for multiple reasons to localize their food purchases as much as possible.

Long-term storage is another popular option. Canned foods, MREs, and freeze dried meals are selling out quickly even as prices rise. But one component that is conspicuously absent in shelf-stable food is high-quality protein. Most survival food companies offer low quality “protein buckets” or cans of meat, but they are often barely edible.

Prepper All-Naturals offers premium cuts of steak that have been cooked sous vide and freeze dried to give them a 25-year shelf life. They offer Ribeye, NY Strip, and Tenderloin among others.

Having buckets of beans and rice is a good start, but keeping a solid supply of high-quality protein isn’t just healthier. It can help a family maintain normalcy through crises.

Prepare Without Fear

With all the challenges we face as Americans today, it can be emotionally draining. Citizens are scared and there’s nothing irrational about their concerns. Being prepared and making lifestyle changes to secure necessities can go a long way toward overcoming the fears that plague us. We should hope and pray for the best but prepare for the worst. And if the worst does come, then knowing we did what we could to be ready for it will help us face those challenges with confidence.

I love it people buy debt with debt … you have a dollar . A reserve NOTE . A note is an instrument of debt . You buy a bond . An instrument of debt . You expect wealth in the form of interest . But what do they give you . Dollars for interest . So you use debt to buy debt to get and they give you more of a debt instrument. The principal is returned to you in dollars . It’s still not wealth but debt.

An you expect to get a head . You expect to make wealth . You think bonds can’t fail .

You are an idiot .

Duncan Adams